Panama7

Introduction

In January, I wrote an article titled My Six-Figure Market-Beating Dividend Growth Portfolio. In that article, I explained my strategy and showed readers my portfolio.

Now, it’s time to write an update, as this is the single-most requested article by readers over the past few months. Especially in light of changing market conditions and the fact that I’ve been busy transforming my portfolio, it’s important to write an update. Or to writ

Hence, in this article, I will show you my dividend growth portfolio, which accounts for more than 90% net worth. I will guide you through my holdings and explain which changes I’ve made over the past few months.

Needless to say, I will also go over my expectations for the future and explain how I’m dealing with high market uncertainty.

So, let’s get to it!

About Me & My Strategy

My Goals Are Largely Undefined. My Strategy Isn’t.

As I explained last time, I only put six figures in the title to emphasize the seriousness of my portfolio. While it’s not a number that will allow me to retire in the short term, my portfolio has enough firepower to have a serious impact on my life. While the portfolio isn’t large enough to allow me to quit working, it’s also not small enough to allow me to make stupid mistakes.

I do not invest following a specific investment schedule. I buy whenever I see opportunities. Sometimes I go months without investing large sums – except for dividend reinvestments.

With that said, I’m 27 – about to turn 28 this month. As most of my readers know, I have a background in supply chains and finance. I advise funds and incorporate a big part of my thesis in the articles I wrote on Seeking Alpha.

My background is also visible in the stock picks you’re about to see. I own a lot of industrial companies and firms with key positions in major supply chains, which provides me with stability.

I also do not maintain a clear retirement goal. I’m honestly not planning on ever retiring or working a job that makes me count the days to my retirement.

Hence, my strategy is to build a bulletproof portfolio of stocks that, I believe, will generate tremendous long-term value for various potential purposes. If this works out, I can always do whatever I want, whether it is retiring early, investing in new businesses, or just accumulating wealth for the next generation.

In my prior article, I gave three reasons why I’m investing:

- Investing for financial independence.

- Protecting my money against inflation.

- Because it’s so much fun.

So, while I don’t have extremely clear and straightforward goals, I do have a clear strategy. This is also suitable for Seeking Alpha, as I try to cater to a wide variety of readers with unique strategies.

Whether it’s retiring early, protecting your wealth, or something else, I hope that my portfolio and strategy offer some food for thought.

My strategy

I mainly invest in long-term dividend growth stocks. However, I also incorporate certain high-yield investments like energy, utilities, and real estate stocks. I do this to combine the best of two worlds: income and growth.

If I were 60 instead of 27, my strategy would likely be different. After all, the closer to retirement we get, the more important it is to focus on income over potential future income growth.

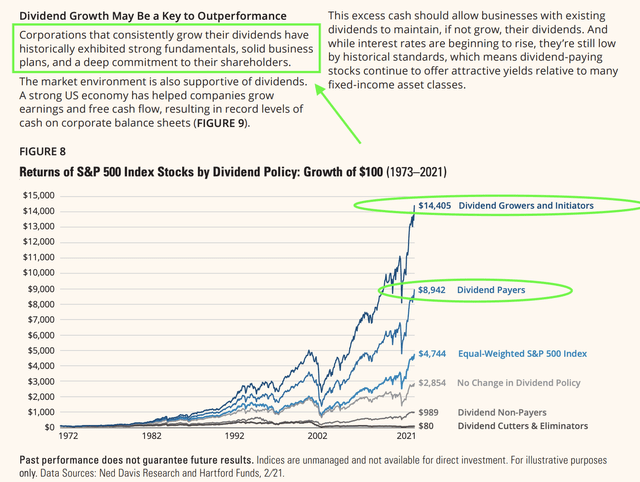

However, for now, I focus on dividend growth for one major reason: it tends to be the holy grail of investing.

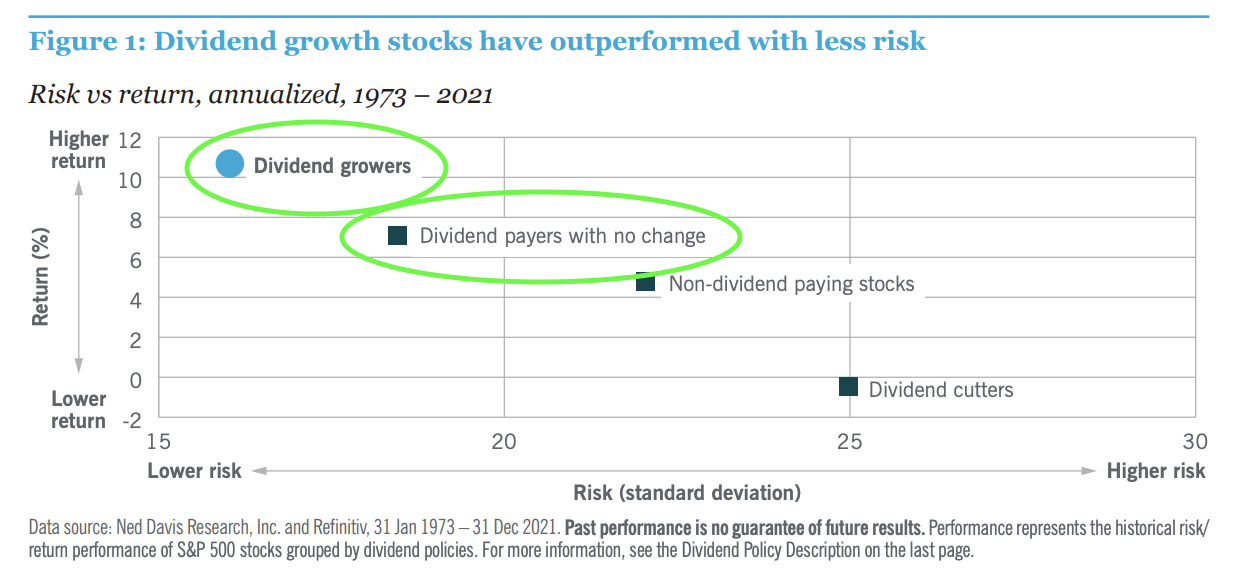

Historically speaking, dividend growth stocks have outperformed the market with subdued volatility. Essentially, it’s a case of lower risks with a higher return – which is unusual, as most people believe the higher the risk, the higher the return.

Nuveen (Author Annotations)

The thing is, running a business is no easy task. And when you add the challenge of distributing dividends, it becomes even more demanding since it involves additional cash outflow. This emphasizes the implementation of efficient and effective capital allocation strategies by companies.

Nevertheless, the fact that companies distribute dividends indicates they are on the right track. Consequently, during periods of market decline, high-quality companies that pay dividends often excel, providing a measure of protection against downward trends in one’s investment portfolio.

Furthermore, these dividend-paying companies typically perform well in bull markets, offering investors a combination of stability and superior returns when investing in dividend stocks.

This advantage becomes even more pronounced when dealing with dividend growth stocks, which not only pay dividends but also increase them steadily, offsetting inflationary headwinds.

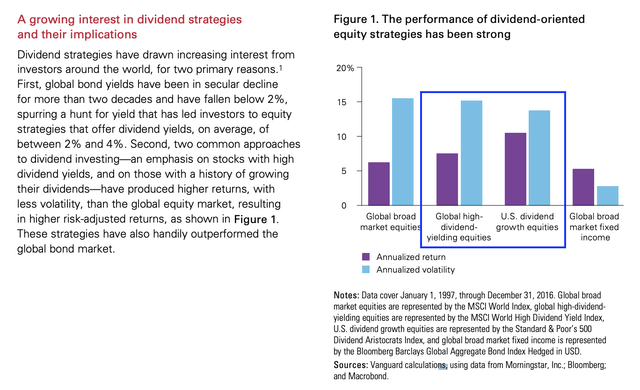

This is also confirmed by Vanguard research.

[…] an emphasis on stocks with high dividend yields, and on those with a history of growing their dividends—have produced higher returns, with less volatility, than the global equity market, resulting in higher risk-adjusted returns […]

Vanguard

Research from Hartford Funds confirms the favorable risk/reward of dividend growth equities, as the fund writes that:

Dividends have historically played a significant role in total return, particularly when average annual equity returns were lower than 10% during a decade.

[…] Furthermore, dividend growers and initiators have historically provided greater total return with less volatility relative to companies that either maintained or cut their dividends.

Hartford Funds

In this case, when I say dividend growth stocks, I am not referring to growth stocks but value stocks that come with growth – as vague as that may sound.

Growth stocks are often companies with low profits (or losses) and expectations of fast growth in the future. Essentially, I prefer to buy stocks that:

- Operate in industries with high entry barriers.

- Are dominant in the supply chain they operate in.

- Have healthy balance sheets.

- Generate steadily rising free cash flow.

- Are eager to let shareholders benefit from their success (dividends, buybacks).

- Can withstand the test of time (new technologies, changing demographics).

- Have political influence (i.e., defense, energy, and railroads).

In the case of political influence, I’m not saying that I want companies that bribe politicians, but companies that are so important in certain areas that their operations are largely immune to the consistently changing winds on Capitol Hill.

Now, with all of this in mind, let me show you my portfolio!

My 22-Stock Portfolio

The Breakdown Of My Holdings

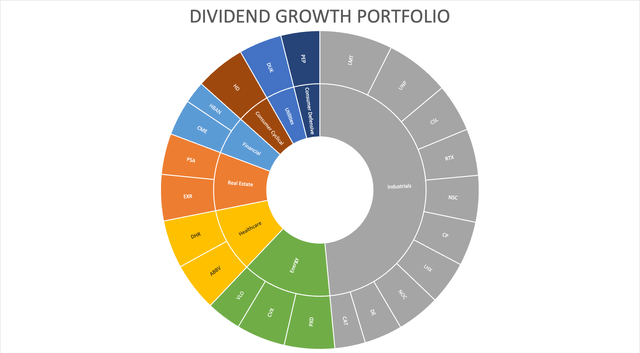

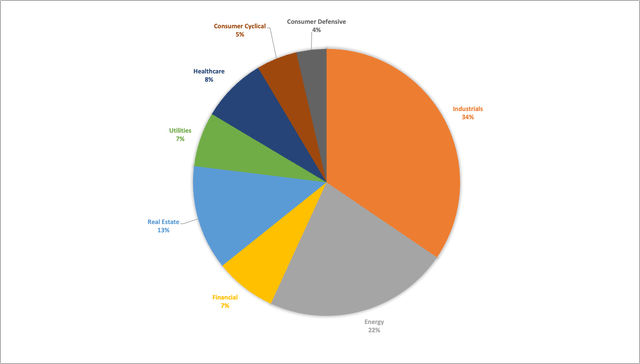

My portfolio consists of 22 individual stocks in eight sectors. I started this portfolio in June 2020 when I got serious about long-term investing. My experience goes back way more than that.

The biggest sector – by far – is the industrial sector, which accounts for almost half of my portfolio exposure.

Leo Nelissen

Almost needless to say, my goal isn’t to copy any ETF or index. I buy whatever I like – as long as it makes sense when put together in a basket (my portfolio).

For example, I own Union Pacific, Canadian Pacific Kansas City, and Norfolk Southern, which gives me significant intermodal, bulk, and Mexico (supply chain re-shoring) exposure.

I own CME Group because of its large footprint in the financial services industry, and I bought Huntington Bancshares because it’s a cornerstone in the Midwest.

Deere & Company I bought because I believe there is no better way to benefit from the long-term agriculture bull case than through leading machinery.

Caterpillar is correlated to Deere. However, I added that one because it’s one of the best ways to benefit from long-term mining demand without having to buy mines with geopolitical risks.

I also exclusively buy North American equities, as I do not like the current approach of European nations (read: I don’t trust EU politicians). The same goes for emerging markets. I prefer to buy emerging market exposure via North American equities. I avoid jurisdictions with limited transparency. So far, this strategy has suited me extremely well.

It also needs to be said that my portfolio isn’t nearly as cyclical as one might think. My single-largest industry is aerospace & defense. In that industry, I mainly buy defense companies. These companies are part of the industrial sector, yet anti-cyclical due to their government exposure. While that also comes with risks, it lowers my overall portfolio volatility.

Here’s an overview of the industries in my portfolio:

| Industry | Weighting |

| Banking Services | 2.2% |

| Investment Banking & Investment Services | 3.6% |

| Beverages | 3.9% |

| Electrical Utilities & IPPs | 4.4% |

| Homebuilding & Construction Supplies | 4.9% |

| Healthcare Equipment & Supplies | 4.9% |

| Pharmaceuticals | 4.9% |

| Specialty Retailers | 5.1% |

| Machinery, Equipment & Components | 7.0% |

| Residential & Commercial REIT | 8.8% |

| Oil & Gas | 13.6% |

| Freight & Logistics Services | 15.7% |

| Aerospace & Defense | 21.0% |

Note that freight & logistics services are mainly railroads. Oil and gas include refinery exposure.

Below is a full list of my stocks, the industries they operate in, and the total weighting.

Leo Nelissen

| Name & Ticker | Industry | Weighting |

| HUNTINGTON BANCSHARES INC. (HBAN) | Banking Services | 2.2% |

| CATERPILLAR INC. (CAT) | Machinery, Equipment & Components | 3.1% |

| VALERO ENERGY CORP. (VLO) | Oil & Gas | 3.5% |

| CME GROUP INC. (CME) | Investment Banking & Investment Services | 3.7% |

| DEERE & CO (DE) | Machinery, Equipment & Components | 3.9% |

| PEPSICO, INC. (PEP) | Beverages | 4.0% |

| PUBLIC STORAGE (PSA) | Residential & Commercial REIT | 4.1% |

| DUKE ENERGY CORP. (DUK) | Electrical Utilities & IPPs | 4.4% |

| L3HARRIS TECHNOLOGIES, INC. (LHX) | Aerospace & Defense | 4.4% |

| NORTHROP GRUMMAN CORP. (NOC) | Aerospace & Defense | 4.4% |

| CANADIAN PACIFIC KANSAS CITY LTD. (CP) | Freight & Logistics Services | 4.5% |

| EXTRA SPACE STORAGE INC. (EXR) | Residential & Commercial REIT | 4.6% |

| NORFOLK SOUTHERN CORP. (NSC) | Freight & Logistics Services | 4.7% |

| RAYTHEON TECHNOLOGIES CORP. (RTX) | Aerospace & Defense | 4.8% |

| DANAHER CORP. (DHR) | Healthcare Equipment & Supplies | 4.9% |

| CARLISLE COMPANIES INC. (CSL) | Homebuilding & Construction Supplies | 4.9% |

| ABBVIE INC. (ABBV) | Pharmaceuticals | 4.9% |

| CHEVRON CORP. (CVX) | Oil & Gas | 5.0% |

| THE HOME DEPOT, INC. (HD) | Specialty Retailers | 5.1% |

| PIONEER NATURAL RESOURCES CO (PXD) | Oil & Gas | 5.1% |

| UNION PACIFIC CORP. (UNP) | Freight & Logistics Services | 6.5% |

| LOCKHEED MARTIN CORP. (LMT) | Aerospace & Defense | 7.4% |

At this point, it is important to elaborate on a few things.

- New additions to my portfolio are Carlisle Companies and Pioneer Natural Resources. Carlisle is an industrial distributor with a focus on construction. I bought the stock at a very attractive valuation and believe that its dividend growth characteristics are a perfect fit for my portfolio. I bought Pioneer because it comes with a highly attractive special dividend. PXD is one of the most efficient oil drillers in North America, which distributes almost all of its free cash flow to shareholders. I sold Exxon Mobil (XOM) at an almost 300% profit to buy PXD shares. I do not dislike Exxon, but I prefer special dividends in the oil space. I discussed that in these two articles (Exxon and Pioneer).

- I aggressively added to Danaher, making it one of my largest position after it was my smallest position earlier this year.

- I also added to industrial stocks like Union Pacific, Norfolk Southern, and L3Harris Technologies.

- I doubled my Home Depot investment.

- I boosted my only consumer staple position, PepsiCo.

- I bought more Extra Space Storage exposure and boosted my position in Public Storage.

- I sold Nasdaq (NDAQ) because I already owned CME Group and because I preferred other investments for tax reasons.

In other words, I have done exactly what I said I would do earlier this year:

My strategy isn’t changing, except that I hold way more cash than usual. I expect to use bigger corrections to aggressively add to some cyclical holdings of mine. I’m also going to invest in my smallest positions to keep the portfolio a bit more balanced. This includes Danaher, PepsiCo, and Public Storage.

Furthermore:

- Due to weakness in cyclical stocks and the timing of new investments (I am very satisfied with the entry prices of new investments), my portfolio has a current (pre-tax) dividend yield of 3.0%.

- While it’s hard to estimate the dividend growth rate due to special dividends, I estimate that the three-year weighted average annual dividend growth rate of my portfolio is 9.9%.

The current dividend breakdown looks like this:

Leo Nelissen (Portfolio Dividend Distribution)

This brings me to the next important discussion.

Portfolio Performance

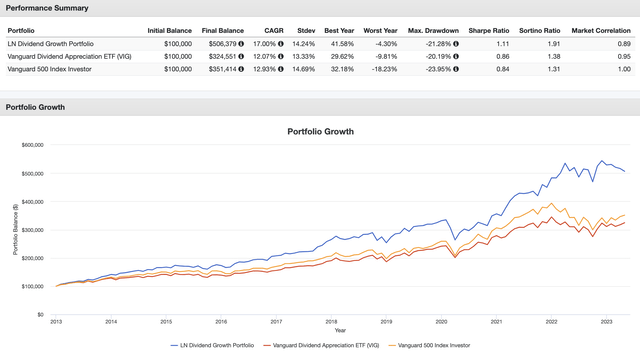

Please note that the numbers you see below are based on my current holdings. In other words, they do not take timing into account. I’m essentially backtesting my holdings.

Since 2013, my portfolio has returned 17.0% per year, beating the S&P 500 by 400 basis points per year. The Vanguard Dividend Appreciation ETF (VIG) returned 12.1% per year. In this case, my portfolio picks did very well despite having no technology exposure, which benefited the S&P 500 so much.

Also, the standard deviation of my portfolio was slightly below the standard deviation of the market, despite the fact that my portfolio is massively overweight industrials and energy. It confirms my theory that the mix is still value-adding – especially because half of my industrial exposure is anti-cyclical.

Portfolio Visualizer

The numbers also confirm the theory that dividend growth stocks can provide outperforming returns with subdued volatility.

Backtesting my portfolio picks shows a highly favorable risk-adjusted return as the Sharpe Ratio is 1.11. The Vanguard ETF beat the S&P 500 on a risk-adjusted basis as well.

Furthermore, the outperformance is consistent. The portfolio has consistently outperformed the market with slightly lower volatility.

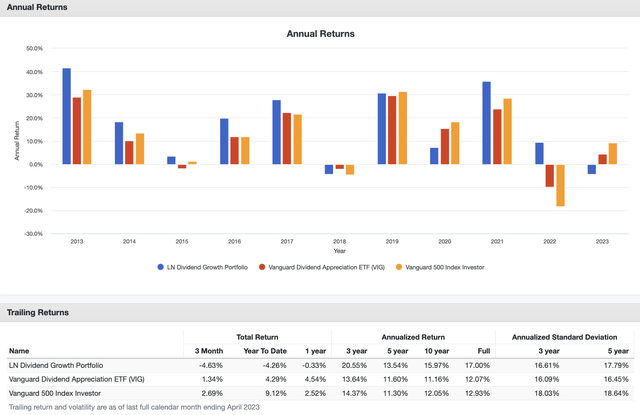

Unfortunately, the portfolio significantly underperformed in 2020 when the S&P 500 benefited from its technology exposure. Back then, my portfolio suffered from its energy and industrial exposure.

Portfolio Visualizer

However, my industrial and energy exposure quickly turned into a blessing. In 2020, I was buying industrial and energy stocks with both hands. This resulted in strong outperformance in 2021 and 2022, when inflation rose, which pressured growth stocks. It caused a rush into value stocks, which benefitted my portfolio.

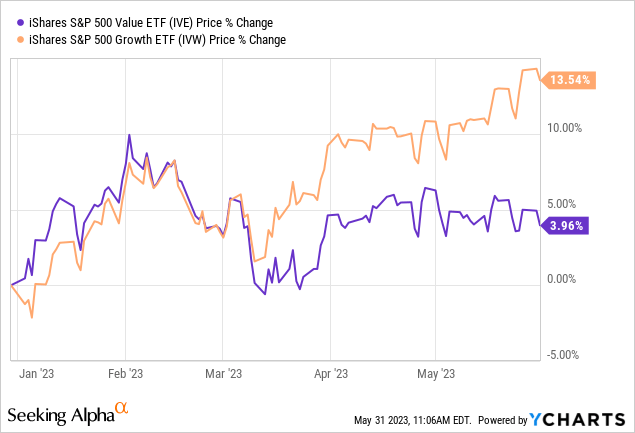

Unfortunately, 2023 is off to a rough start again. Ending April 2023, my portfolio is down 4.3%. The market is up 9%.

As the overview below shows, there is – once again – a rotation from value to growth. The market is betting on a quick and rapid decline in inflation and interest rates. While inflation is certainly coming down, I’m not in the camp of people who bet on such an outcome.

I am currently boosting my cash position again to buy beaten-down cyclical stocks.

What I Expect Going Forward

I expect to underperform the market for the time being. Economic growth is rapidly going south, which is hurting cyclical stocks. Political games in Washington are hurting defense companies, and consumer weakness is keeping a lid on Home Depot.

Also, inflation is persistent, which is likely to keep rates higher for longer.

While all of this may sound bad, I couldn’t be more relaxed.

First of all, I did correctly predict the current macro environment. Growth slowing and higher-than-expected rates have been on my agenda for a while. It’s also why I mainly added cyclical holdings on weakness.

Going forward, I expect to add to cyclical holdings like railroads and consumer cyclical during steeper corrections.

I’m also looking to expand my real estate segment, which currently consists of only two holdings – both in the self-storage space.

In terms of timing, I believe we could see a bottom in economic growth going into next year. So, while 2023 will likely remain challenging, I think 2024 might be a much better year for dividend investors.

Takeaway

Investing in dividend growth stocks has been the cornerstone of my wealth-building strategy, providing long-term value and stability. With over 90% of my net worth invested, I prioritize industries with high entry barriers and dominant positions in supply chains.

This approach allows me to generate income while also benefiting from future growth potential. Historical data and research support the outperformance and lower volatility of dividend growth stocks, making them an attractive investment choice.

My 22-stock portfolio, consisting of diverse sectors such as aerospace & defense, oil & gas, and REITs, has delivered solid returns, outperforming the S&P 500 by 400 basis points annually since 2013.

While recent market conditions have led to some underperformance, I remain committed to my strategy and see opportunities in cyclical stocks.

Despite short-term challenges, I believe in the long-term potential of my portfolio and the benefits it can provide for financial independence and wealth accumulation.

Going forward, I will keep investors up-to-date and explain which stocks I’m looking to add to and/or initiate a position in.

I’ll keep you up-to-date!