New research shows even Australia's most affluent households are experiencing high levels of financial stress, with more pain ahead.

The latest Bill Stress Index compiled by Compare Club found that 30% of all households spend between 50% and 70% of their income on paying bills.

Shockingly, even Australians earning middle-class or above salaries are struggling, with 52% of respondents with a personal income of $125,000 feeling “highly stressed”.

Currently, the biggest concerns for upper-income earners are energy (49%), mortgages (34%) and property insurance (21%).

Even wealthy Australians are feeling the pain from the rising cost of living. Photo: NCA NewsWire/Tertius Pickard

Young people, parents and those with lower incomes have seen the biggest increases in financial stress levels, according to the index.

However, almost half of respondents were worried about their ability to pay their utility bills, up from 23% since the index was last compiled in May.

Other expenses that cause the most stress for households, according to the Comparison Club survey, are mortgages (33%), rent (24%) and property insurance (22%).

The findings are in line with those of financial comparison website finder.com.au, which found 79 per cent of households said they were “somewhat” or “very” stressed about their finances.

Bill stress levels are rising.

'enormous stress'

The bi-annual Bill Stress Index also found that 27% of households were spending between a third and half of their income each month, and 12% were spending more than 75%.

And in perhaps the strongest sign of bill stress, people aged 35 to 44 are spending 75% more on monthly bills, a staggering 220% increase since May.

“The rise in bill-related anxiety in such a short space of time shows the real impact that rising inflation and the cost of living are having on Australians,” Compare Club head of research Kate Brown said.

“It's clear that the strategy of raising interest rates to manage the economy is causing a lot of financial stress for many people.”

The cost of everything is skyrocketing. Photo: NCA NewsWire

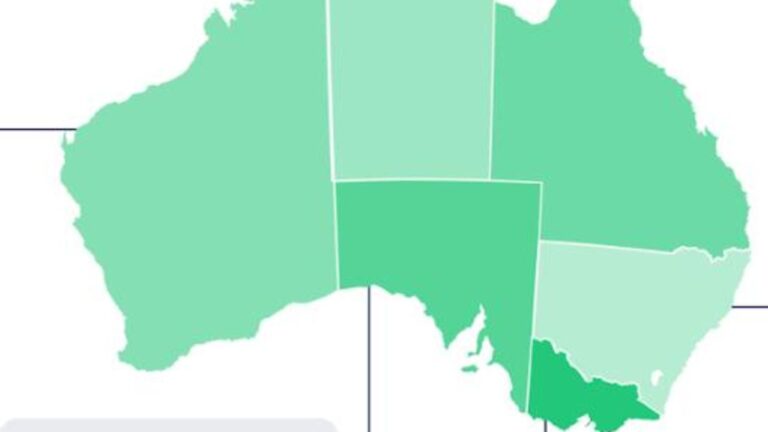

Overall, people living in Queensland report the highest level of stress (49%), followed by Western Australia (47%), New South Wales (46%), South Australia (45%) and Victoria (44%).

More than 71% of respondents reported cutting back on unnecessary expenses to combat the rising cost of living.

Graham Cook, head of consumer research at finder.com.au, said the cost of living crisis had “wreaked havoc” on many households this year.

“The cost of everything from housing to groceries to gasoline and energy is rising, and the economic situation is the worst it's been in decades,” Cook said.

A report by non-profit crisis relief group Foodbanks Australia says half a million households are struggling to put food on the table every day.

Half a million Australians struggle to put food on the table every day. Photo: Dean Martin

Over the past year, funding shortages have led to more than 3.7 million households going food insecure, skipping meals or going without food for entire days.

“We know how important it is for people to have access to nutritious food, but rising costs of energy, fuel, groceries, rent and mortgages have put this basic need out of reach and leaving more and more people with no breathing room,” said Brianna Casey, the food bank's CEO.

The charity is facing “unprecedented” demand for help ahead of Christmas, with demand increasing by 200 per cent in some parts of the country.

Charities are being inundated with needy Australians asking for help. Photo: Richard Walker

In Victoria alone, food banks feed around 57,000 people every day, and nationally, 60 per cent of people who apply for help have at least one member in paid employment.

Rising mortgage costs

The average Australian homeowner is now paying $3,883 per month on their mortgage repayments, according to Canstar analysis.

This represents an average increase of around $1,800 per month since the RBA began raising interest rates in May 2022.

New research from Roy Morgan has found that 1.51 million mortgage holders are currently at risk of experiencing mortgage stress, an increase of a staggering 700,000 households since interest rates began rising.

The number of homeowners deemed “extremely at risk” reached 967,000, nearly a fifth of all mortgage holders and well above the long-term 10-year average of 14.1%.

Loading embeds…

Michelle Levine, chief executive of Roy Morgan, said the last time mortgage stress levels were this high was immediately after the global financial crisis.

“The rise in interest rates over the past year has significantly increased the number of mortgage holders considered 'at risk,'” Levine said.

“With further price increases expected in the coming months, these figures are set to soar even more as people adjust their lifestyle choices to cope with the increased payments.”

Based on current benchmark interest rates, the cost of repaying that mortgage would be about $3,202 per month.

Since interest rates began rising, that amount has increased by about $1,400 per month.

The number of Australians in financial difficulty continues to grow.

Compare Club's Bill Stress Index found that 33% of homeowners are worried about how much they can afford to pay, up from 27% in May.

Meanwhile, the average mortgage size for first-time home buyers has reached $507,000, according to the latest Australian Bureau of Statistics data.

That's about $100,000 more than before the COVID-19 pandemic, thanks to soaring real estate prices and 13 interest rate hikes in just 18 months.

Rents are expected to rise further

An expert panel of 38 economists and financial analysts surveyed by finder.com.au found that the majority expect rental prices to continue to rise through 2024.

The commission predicts rents in Perth could rise by about 9.5 per cent by the end of next year, 6.8 per cent in Melbourne and 6.5 per cent in Sydney.

Modelling by finder.com.au shows the average income needed to live in a rental property across the country.

Based on these projections and pricing models, the minimum household income needed to afford rent in Sydney is a whopping $127,339, the highest in the country.

Cook said more than 42 per cent of tenants were already struggling to pay their rent.

“Much of the discussion around rising interest rates focuses on homeowners, but it's actually renters who are feeling the impact of rising rents more than any other way,” he said.

“Further rent increases will not be welcome news for those struggling.”

Professor Mark Crosby from Monash University Business School said costs would inevitably continue to rise due to surging demand and constrained supply.

“Lack of supply is likely to continue to have an impact on the rental market, particularly as immigration continues to put pressure on this market,” Prof Crosby said.

Politicians demand supermarket action

A Senate inquiry looking into supermarket pricing is set to begin in Canberra amid a cost-cutting drive, with one political leader calling for stiff fines for unfair pricing.

A Senate inquiry is being held into supermarket pricing practices. Photo: iStock

The wide-ranging investigation will look into everything from supplier arrangements to unnecessary price hikes.

National Party leader David Littleproud wants the Government to use strong measures to pressure Woolworths and Coles to do the right thing.

“Under the Grocery Code of Conduct, currently the maximum fine for a supermarket to deceive suppliers and consumers is $64,000 but it should be more than $10 million,” Mr Littleproud said.

“The cost of living crisis is now, not the middle of next year, and people will struggle to put a Christmas ham on the table.”

Further relief unlikely

Treasurer Jim Chalmers told reporters in Canberra yesterday he downplayed the likelihood of further government support for struggling Australians.

People struggling with the cost of living crisis and mortgage stress “should not expect any major new measures” until the Government publishes its next Budget in May.

This is despite the government's interim economic report due next week being expected to show a “much healthier fiscal position” and a $9 billion budget surplus.

“We understand and recognise that people are facing significant increases in the cost of living, but we are seeing welcome and encouraging progress in the fight against inflation,” Dr Chalmers said.

“Our cost of living plan is intended to relieve some of these cost of living pressures without increasing inflation.”