European used luxury goods market

DUBLIN, March 5, 2024 (GLOBE NEWSWIRE) — 'Europe' by Type (Jewelry, Watches, Handbags, Clothing, Small Leather Goods, Footwear, Accessories, Others) and Demographics (Men, Women, Unisex) “Used Luxury Goods Market Report''), Distribution Channel (Offline, Online), and Countries 2024-2032'' report added ResearchAndMarkets.com Recruitment.

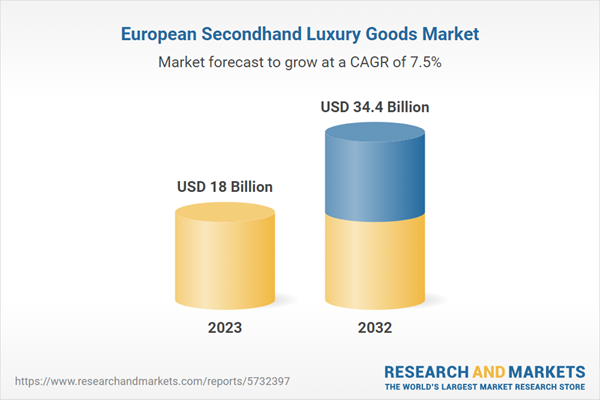

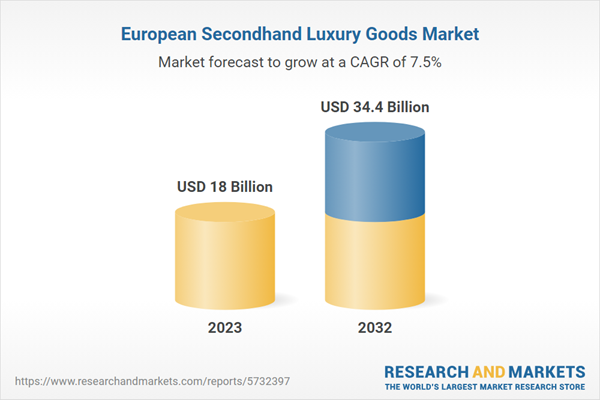

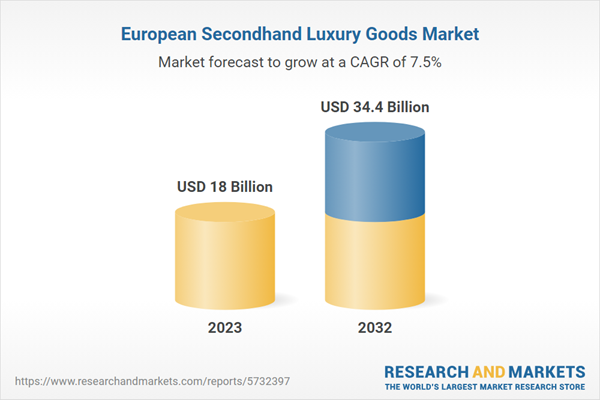

The European used luxury goods market size is expected to reach USD 18 billion in 2023 and reach USD 34.4 billion by 2032, exhibiting a growth rate (CAGR) of 7.47% from 2023 to 2032. .

Increasing demand for sustainable and unique luxury options, increased access to iconic brands at lower costs, and increasing number of shoppers seeking value and scarcity are key factors driving market growth This is one of the.

Used luxury goods include used luxury items such as fashion items, accessories, and collectibles from famous brands. These items often have lasting quality and timeless appeal. As sustainability gains traction, consumers appreciate the environmentally friendly aspects of extending the lifecycle of luxury goods.

The used luxury market offers individuals a more affordable way to acquire iconic brands, attracting value-conscious buyers and collectors. Digital platforms and certification services ensure product authenticity. The appeal of second-hand branded items lies in their unique stories and the thrill of discovering a rare bargain. Some items become even more popular over time, making them even more special.

Increasing consumer awareness of sustainability, in line with environmentally conscious values, has led to a growing preference for second-hand luxury goods, contributing to the uptake of luxury goods in Europe. Furthermore, the increasing appeal of access to premium brands at more affordable prices attracts both budget-conscious buyers and value-seeking aspirational consumers, positively impacting market growth. I am. Apart from this, rapid digital transformation that enables online platforms to seamlessly connect buyers and sellers is driving market growth.

Additionally, the growing popularity of authentication services that address concerns about product authenticity is accelerating product adoption rates. Additionally, the rarity and exclusivity of certain vintage and limited edition items make the second-hand market an attractive source for collectors, driving its growth. In addition, the circular economy movement promotes recycling of luxury goods, leading to waste reduction and contributing to market growth.

European Used Luxury Goods Market Trends/Drivers

Growing demand for sustainable consumption

The European used luxury goods market is driven by growing consumer preference for sustainable consumption practices. As environmental concerns grow, more consumers are looking for ways to reduce their carbon footprint and minimize waste. This has led to a significant increase in demand for second-hand luxury goods that are in line with the principles of circular economy and responsible consumption.

The appeal lies in the ability to own high-quality, popular products at a fraction of the original price, while also helping to reduce the overall demand for new products. This change is forcing luxury brands and retailers to adopt strategies that include second-hand products, further boosting the growth of Europe's second-hand luxury goods market.

The impact of online platforms and digitalization

The rapid growth of online platforms and digitalization is playing a vital role in driving the European second-hand luxury goods market. The increased convenience and accessibility of e-commerce platforms has democratized the luxury goods market, making it easier for buyers and sellers to connect regardless of geographic boundaries. Online platforms have created a global market for used luxury goods, expanding the potential customer base and driving market growth.

Furthermore, digitization has increased transparency and authentication processes, eliminating concerns about the authenticity and condition of second-hand goods. As a result, consumers are confident in their online purchases, further driving the expansion of Europe's second-hand luxury goods market.

Jewelry and watches represent the main product types

The report provides detailed segmentation and analysis of the market on the basis of product type. This includes jewelry, watches, handbags, clothing, small leather goods, footwear, accessories, and more. According to the report, jewelery and watches account for the largest segment.

Jewelry and watches are timeless accessories that hold enduring value and are often associated with tradition and craftsmanship, making them prime candidates for second-hand trade. The allure of owning a well-known brand at a more affordable price leads consumers to consider second-hand options. Online platforms provide a global marketplace for buyers and sellers, expanding the reach of these luxury goods. Additionally, the rarity and uniqueness of certain pieces create a sense of exclusivity that resonates with discerning consumers.

Additionally, enhanced authentication methods and transparent authentication processes eliminate concerns about authenticity, giving customers more confidence in purchasing pre-owned jewelry and watches. As sustainable practices gain traction, choosing pre-owned jewelry and watches is consistent with environmentally responsible consumption and will drive growth in this segment.

Men hold the majority of market share

Detailed segmentation and analysis of the market based on demographics is also provided in the report. This includes men, women, and unisex. According to the report, men accounted for the largest market share.

As consumers, men often look for quality, exclusivity and value, which align perfectly with the appeal of second-hand luxury goods. This demographic's affinity for iconic brands and finely crafted accessories has helped expand the market, leading major companies to carefully select products that specifically cater to their interests. From vintage watches to designer apparel, men's participation fosters a vibrant ecosystem where timeless elegance meets sustainability.

Their efforts reflect changing consumer behavior and highlight the enduring appeal of luxury craftsmanship. As Europe's second-hand luxury goods market continues to flourish, male influence remains essential, shaping a landscape that blends luxury and conscious consumption, while also serving as a dynamic venue for style-conscious individuals. We have solidified our position in the market.

Used luxury goods are mainly distributed through offline channels

Detailed segmentation and analysis of the market is provided on the basis of distribution channels. This includes offline and online. According to the report, offline accounted for the largest market share.

The main factors driving the growth of the offline segment are physical boutiques, vintage stores, and luxury consignment stores that offer discerning consumers a tactile, personalized experience that cannot be replicated through online platforms. Its reach and response. These brick-and-mortar stores feature a carefully selected selection of rare second-hand items that are sourced with the utmost care, offering a tangible connection to craftsmanship and tradition. The allure of exclusivity and the opportunity to see products first-hand increases consumer trust and fosters lasting relationships. Professional staff, often with deep product knowledge, guide buyers through their choices and inject trust and authority into the purchasing process.

In addition, the physical space provides a platform for selected events, exhibitions and consultations, reinforcing the market's position as an authoritative hub for luxury expertise. The synergy between offline channels and the used luxury sector creates engagement, highlighting the enduring appeal of face-to-face interactions in an increasingly digital era and demonstrating the market's credibility and excellence in the realm of sophisticated luxury. To do.

France has a clear advantage in the market

Detailed segmentation and analysis of the market is provided on the basis of countries. This includes France, Italy, the United Kingdom, Germany, Russia, Spain, and more. According to the report, France accounted for the largest market share.

France is a country with a rich tradition and sophisticated sensibilities that leads Europe's used luxury goods market. Known as the global epicenter of luxury fashion, the country's historic fashion houses and iconic brands have imbued a culture of timeless elegance. This heritage has fostered a thriving market for second-hand luxury goods, where authenticity and craftsmanship are paramount. France's vintage boutiques and markets offer a carefully selected selection of popular pieces that celebrate the marriage of tradition and innovation.

Additionally, the allure of owning a piece of French luxury history attracts discerning buyers seeking both unique discoveries and sustainable options. France's deep ties to luxury goods, coupled with its appeal as a trendsetter, will shape the direction of Europe's second-hand luxury market, underscoring the enduring appeal of refined luxury with a Gallic touch It is positioned as a natural influencer.

competitive environment

The market is steadily growing as various leading companies drive innovation by incorporating advanced authentication technologies such as AI-powered algorithms to ensure product authenticity. The user experience is enhanced with an intuitive interface and virtual try-on feature that allows customers to visualize products before purchasing. Sustainability remains a priority, which can be seen in our eco-friendly packaging practices and exclusive collaborations with luxury brands.

Additionally, leading companies are adopting blockchain technology to ensure transparent record-keeping and verification of provenance. Additionally, streamlined logistics and supply chain strategies optimize transaction speed. These innovations collectively demonstrate the commitment of leading companies to provide reliable, easy-to-use and sustainable solutions to meet the growing demand for used luxury goods.

Key questions answered in this report

-

How big will the European used luxury goods market be in 2023?

-

What is the expected growth rate of the European used luxury goods market from 2024 to 2032?

-

What are the key factors driving the European used luxury goods market?

-

How has COVID-19 affected the European second-hand luxury goods market?

-

What is the breakdown of the European used luxury goods market by product type?

-

How is the European used luxury goods market segmented based on demographics?

-

What is the breakdown of the European used luxury goods market by distribution channel?

-

What are the key regions for the European used luxury goods market?

-

Who are the key players/companies in the European used luxury goods market?

Key attributes:

|

report attributes |

detail |

|

number of pages |

136 |

|

Forecast period |

2023-2032 |

|

Estimated market value in 2023 (USD) |

$18 billion |

|

Projected market value to 2032 (USD) |

$34.4 billion |

|

compound annual growth rate |

7.4% |

|

Target area |

Europe |

Competitive analysis

For more information on this report, please visit https://www.researchandmarkets.com/r/vcq1nk.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source of international market research reports and market data. We provide the latest data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900