On the surface, it appears that U.S. stock indexes such as the S&P 500 have only been moving in one direction lately: up. The same cannot be said for individual member shares.

Most Read on MarketWatch

Charles Schwab's team of strategists highlighted this dichotomy between the relatively calm performance of major stock indexes and the more chaotic movements seen in their constituent stocks in a report released earlier this week. did.

Their findings provide insight into why this bull market is unique compared to past bull markets, and why some are skeptical about the market's rally.

They found that while the S&P 500 index has barely moved from its all-time high in 2024, the average stock price included in the index has been much more volatile.

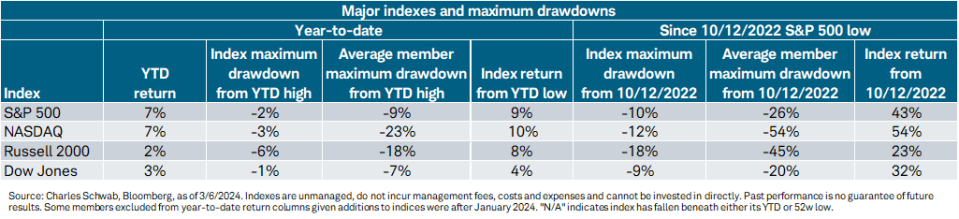

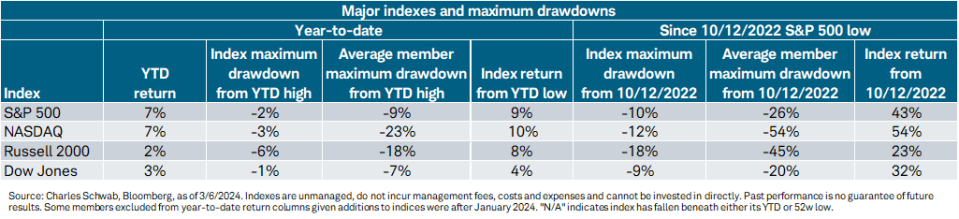

Since the beginning of the year, the S&P 500 SPX has experienced drawdowns of ~2% through Wednesday (compared to 9% for the average index constituent). Kevin Gordon, Schwab's senior investment strategist, who co-authored the report with colleague Liz Ann Saunders, said that the disparity between index-level volatility and the volatility of individual stocks is this wide. He said it was extremely unusual for there to be one.

“This behavior is not typical of a bull market,” Gordon said in a phone interview with MarketWatch. “But at the same time, this is not a typical cycle.”

In fact, Saunders says bulls may not be the best animal to capture the essence of the current market.

“The reality is that the stock market is behaving more like a duck than a bull. It's calm on the surface, but beneath the surface it's paddling like a Dickens,” she said in the report.

The difference is even wider for the Nasdaq Composite COMP, where the tech-heavy index has only had a maximum drawdown of just 3% this year, while the Nasdaq Average has fallen 23% from peak to trough. .

This is true even when measuring performance after October 12, 2022, when the bull market began. Since then, the S&P 500 has risen 43% through Wednesday's close, with a maximum drawdown of 10%. Meanwhile, the average index stock fell 26%, as the chart below shows.

A similar pattern can be observed in the small-cap Russell 2000 RUT and Dow Jones Industrial Average DJIA.

Gordon said the difference between index-level volatility and individual stock volatility points to a skewed market where some stocks mask the relatively weak performance of many index constituents. He said there was.

About half of the stocks in the S&P 500 index are trading below their levels in January 2022, while about 10% of the index's individual stocks have outperformed their levels over the past year. This percentage is historically low at this point in a bull market.

“Typically, after a year or more of a bull market, a much higher percentage of companies are hitting previous highs,” Gordon said.

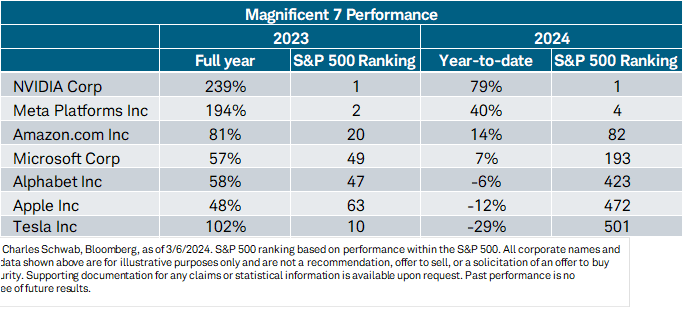

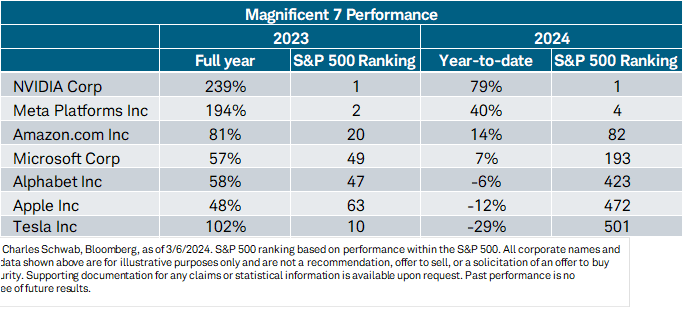

Fortunately for investors who prefer index-tracking funds, the dramatic outperformance of some of the largest U.S.-listed stocks more than offsets the weakness of others. A group of seven mega-cap stocks known as the Magnificent Seven drove much of the S&P 500's 24% rise in 2023, according to FactSet data.

Although some members of this group have lagged since the beginning of 2024, explosive gains from NVIDIA's NVDA and Meta Platforms' META have helped the Schwab team show it in the graph below. It helped to compensate.

The Magnificent Seven consists of Nvidia, Microsoft Corp. MSFT, Apple Inc. AAPL, Amazon.com Inc. AMZN, Meta, Alphabet Inc. GOOGL, and Tesla Inc. TSLA.

The breadth of the market, or the number of individual stocks participating in a bull market, has improved recently, but it hasn't happened in a linear manner. The chart below shows that the percentage of stocks trading above their long-term average has increased since the beginning of the year, but is still below the cycle high from December.

Gordon believes this is a good proxy for participation. The percentage of stocks trading above their 200-day moving average has also proven in the past to be a reliable leading indicator of future troubles.

For example, participation began to decline in late 2021, several months before the S&P 500 index peaked in early January 2022. Similar movements occurred before the coronavirus pandemic disrupted markets in March 2020.

Currently, the width seems to be gradually improving. If this situation continues, the volatility differential between the index and its members should narrow. Gordon and Saunders believe this is essential to continuing the rally.

Investors on Thursday received welcome news on this front as the equal-weighted version of the S&P 500 index XX:SP500EW finally hit a new all-time high since January 4, 2022, according to Dow Jones Market Data. I received some.

The Equal Weight Index has outperformed its market capitalization-weighted counterpart since the beginning of March, another encouraging sign that the index's breadth is improving. So is the fact that the index has largely kept pace with its market-cap weighted peers since its most recent trading session. The bull market started in late October.

One of the most pressing questions for stock investors right now is whether this trend will continue.