Markets are ignoring slowing inflation… are long-term inflation expectations rising again? … Why the Fed will probably be disappointed in the rate cut … What it means for the market

Yesterday, markets ignored a stronger-than-expected rise in the consumer price index (consumer price index) report.

The subsequent big “up” days in stock prices were a bit of a headache.

Here in 2024, the market has soared in anticipation of a rate cut later this year. Historically, lower interest rates are great for stocks (unless they are needed to revitalize a flat economy, which is not the case today).

But when rates begin to cut, and by how much, depends on the Federal Reserve. And as you know, inflation is what drives Fed policy.

Here's what Powell had to say on the subject last week:

The Committee does not expect that it would be appropriate to lower the target range until there is greater confidence that inflation is on a sustained path toward 2 percent.

This is where things get fuzzy.

Fed Chairman Jerome Powell said in Congressional testimony last week that he wanted “a little bit more evidence” that inflation was on track to reach its 2% goal before cutting rates. But he added: “It's not far from there.”

I give 1 point to the rate cut camp.

However, yesterday's CPI statistics were better than expected. This was not a one-off. It became a hit that exceeded expectations for three consecutive months.

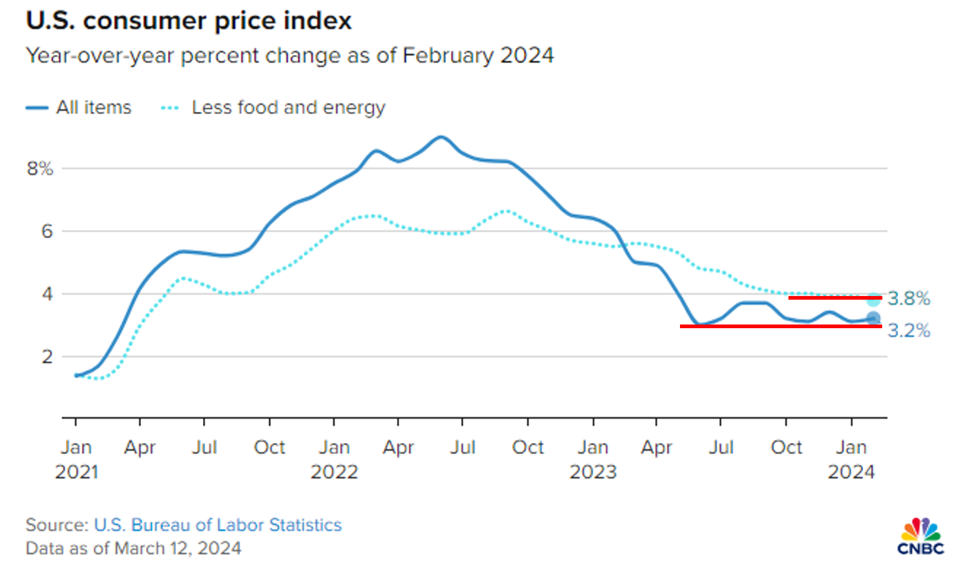

Furthermore, if we zoom out and look at the graphs of headline CPI and core CPI, we can see that inflation appears to be moving “sideways” rather than “down”.

I've added red lines below to show this sideways movement in headline CPI since last spring and core CPI since last fall.

What do you think?

Source: CNBC/BLS data

And here you can see what's happening with real-time inflation in March.

Is inflation starting to come back to a head?

If you want to know more about this, talk to hypergrowth expert Luke Lango.

From Monday's daily notes innovation investor:

Real-time data suggests that inflation is accelerating again in March.

The Bloomberg Commodity Price Index has risen 2% since the beginning of the month. Redfin says asking rents are rising. Inflation expectations are no longer falling.

Taking these factors together, the current estimate for CPI inflation in March is 3.3%, up from 3.2% in February.

In essence, the disinflationary trend we have seen so far is giving way to mild re-inflation in March.

This change is concerning. The general trend over the past 18 months has been that lower inflation leads to higher stocks, while higher inflation leads to lower stocks.

rear [the] On the CPI report, investors will focus on the March CPI report. If disinflation turns into reinflation, it could have a negative impact on stock prices in the short term.

Well, there are two related but different issues we need to address here…

Contrast between reflation and a simple escape from deflation.

Unless the Fed goes “full dovish” too soon, the risk of significant reflation is relatively low, but consumer expectations for long-term inflation could become an issue.

Regarding short-term reinflation, let's go back to Luke.

We believe the re-inflation seen in March will be temporary. It is highly likely that disinflation will resume as early as April.

Additionally, we expect strong earnings and improving economic activity to help address near-term challenges posed by reinflation concerns in March.

We are optimistic about a broader economic recovery in 2024 and expect this to lead to broad-based stock market gains heading into the summer.

We tend to agree with Luke. But keep in mind that the bigger issue is what consumers believe.

After all, if consumers believe that inflation will worsen, they will buy goods and services today at prices they believe will be lower than tomorrow's prices. Of course, it is this purchasing pressure that increases demand and drives prices higher. It's a self-reinforcing feedback loop.

On Monday, we learned that consumer beliefs about inflation are trending in the wrong direction.

from CNBC:

Consumers are increasingly skeptical that the Federal Reserve will be able to meet its inflation target anytime soon, according to a survey released Monday by the New York Fed.

We have kept our forecast for next year at 3%, but this is not the case in the long term. The three-year outlook increased by 0.3 percentage points to 2.7%, while the five-year outlook rose even further by 0.4 percentage points to 2.9%.

All three are well above the Fed's 12-month inflation target of 2%, suggesting the Fed may need to keep policy tight for a long time.

This also relates to the second issue…

Even if a resurgence of inflation is avoided, the stock market may slump if deflation stalls.

In our opinion, this is a bigger risk today.

Is Wall Street getting it wrong again?

It wasn't long ago that Wall Street was convinced there would be seven rate cuts in 2024. It wasn't long ago that Wall Street was confident that there would be a first rate cut in March.

It's no exaggeration to say that Wall Street will go 0-2 on these calls.

In recent months, Mr. Powell has (mostly) stuck to his guns, and expectations for “seven rate cuts” have finally waned. As I write, CME Group's FedWatch tool currently shows that most traders believe the Fed will cut rates three or four quarter points this year.

But are the expectations still too high?

Well, not if you look at the Fed's December 2023 dot plot, which showed three cuts.

As for new things digest Dear Reader, a dotplot is a graph that shows each member's anonymous predictions of what future interest rates will be.

However, remember that the FRB dot plot is dynamic. As Fed members analyze new data, their policy opinions change to reflect that data.

The latest dotplot will be released next Wednesday, when the Fed concludes its March meeting. Is it likely that “three rate cuts” will remain the majority opinion?

The clue for this heading is: bloomberg:

Fed's Kashkari expects two rate cuts in 2024, but only one is possible

As for why the Fed's preferred plan for 2024 is only one or two rate cuts, we can look to Atlanta Fed President Rafael Bostic and his recently coined term.

Bostic wants to avoid any inflationary impact from “pent-up euphoria.”

Bostic is:

In discussions my staff and I have had with business decision makers over the past few weeks, this theme has been one that inspires optimism.

Although business activity has generally slowed down, companies are not in dire straits. Instead, many executives say they are on pause and ready to deploy assets and ramp up hiring when the time is right.

I asked a group of business leaders if they were ready to jump at the first sign of a rate cut.

The answer was a resounding “yes.”

In a market environment where inflation is slowing, it's not good news that companies are “ready to pounce”. This smells like a resurgence in inflation, which the Fed is trying to avoid.

Bostic is now suggesting the Fed will cut rates once in the third quarter and then pause.

from bloomberg last week:

Atlanta Fed President Rafael Bostic said the Fed's first rate cut for the third quarter will be paused at its next meeting to assess how the policy shift will affect the economy. He said he expected that.

“We probably didn't expect them to make back-to-back cuts,” Bostic said. “Given the uncertainty, I think there is some appeal in taking action and seeing how market participants, business leaders and families react to it.”

This is not a harbinger of “three or four” rate cuts in 2024.

Additionally, remember the “ego” part of all this.

Two years ago, Federal Reserve Chairman Jerome Powell already entered the Hall of Infamy for taking advantage of “temporary inflation.” The egg on his face will haunt him for a long time.

Considering this, he may be keenly aware that he wants to avoid becoming this generation's Arthur Burns.

For those not familiar, Mr. Burns served as chairman of the Federal Reserve Board for most of the 1970s. His rate-cutting policies are largely seen as enabling and fueling that decade's brutal inflation.

From Federal Reserve History.org:

Mr. Burns assumed leadership of the Federal Reserve during what became known as the Great Inflation (1965-1982). In other words, monetary easing during this period promoted inflation and a rise in inflation expectations.

Mr. Burns will raise rates, then see inflation fall, assume victory, and cut rates accordingly, but then he will see inflation spike again and require another rate hike.

Today, Citadel Capital billionaire Ken Griffin shares how to avoid this mistake:

If I [the Fed]I don't want to cut it too early.

The worst thing they could end up doing is lowering the interest rate, pausing it, and immediately redirecting it to a higher rate. In my opinion, that would be the most destructive action they could pursue.

So I think the rate cut will be a little bit later than people were expecting two months ago.

Let's be clear about what this means and what it doesn't mean

Even if the Fed doesn't move as fast as Wall Street expects, if our economy holds up, we could see a near-term price correction, but it could derail this bull market, especially given improving earnings. gender is low.

Certainly, certain rate-sensitive sectors of the market could stumble as disappointed bullish traders reallocate capital. But any delay in cutting rates will likely only mean a corresponding delay in the continuation of this bull market.

The bigger risk would be if a “prolonged high'' eventually causes the economy to reverse. However, this is where it becomes difficult to predict.

On the other hand, today's economy is doing quite well. However, questions remain about the resilience of U.S. consumers.

JPMorgan CEO Jamie Dimon captured this tension when he spoke at the Australian Financial Review Business Summit this week. Even though the economy is, in his words, “in some ways booming,” Dimon still believes there is a good chance of a recession.

from bloomberg:

Jamie Dimon said he wouldn't put the possibility of a U.S. recession “off the table” but said the Federal Reserve should wait to cut rates.

“The world is probably pricing in a 70-80% soft landing,” JPMorgan Chase's CEO said via video link at the Australian Financial Review Business Summit in Sydney on Tuesday. said.

“I think there's a half chance of a soft landing in the next year or two. The worst case scenario would be stagflation.”

Even in the face of this uncertain future, our plans remain the same for now…

Stay in the market and continue trading at higher prices.

I'm not saying you should ignore the fundamental indicators that scream “watch out!”, but for now, this is a market that is creating wealth.

So be careful with your position size and stop loss…don't stick your neck out too much…remember the return of Capital is more important than profit upon Capital…but stick with what is working. And today, that means sticking with this bull market.

To learn more about Luke's market analysis and see exactly how he positions your business innovation investor Portfolio, click here.

We will notify you of the latest information.

Good evening,

jeff remsberg