cloudflare

cloudflare

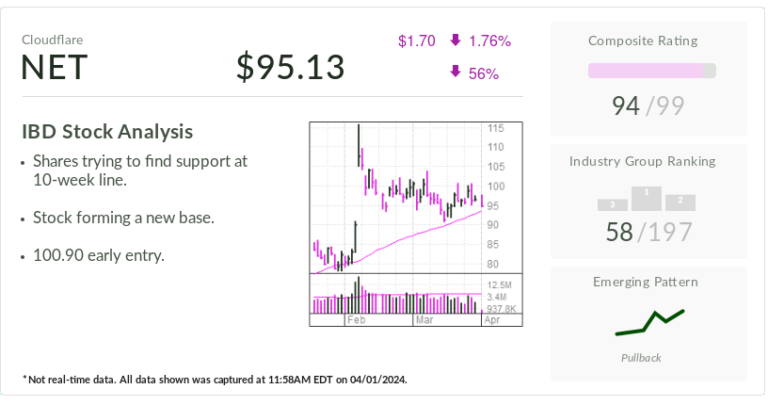

Net

$1.70

1.76%

56%

IBD stock price analysis

- The stock is trying to find support at the 10-week line.

- Stock forming a new base.

- 100.90 early entry.

![]()

Industry group ranking

![]()

new pattern

![]()

pull back

*This is not real-time data. All data shown was obtained on April 1, 2024 at 11:58 AM ET.

cloudflare As investors continue to talk about artificial intelligence stocks, (NET) is the IBD Stock of the Day. Cloudflare stock is up 14% in 2024 and 55% over the past 12 months, but has retreated from its Feb. 9 high of 116.

X

On the stock market today, Cloudflare's stock price fell about 1% to 96.09.

The pullback from the Feb. 9 high requires investors to look for support at the 50-day moving average. From a traditional technical perspective, Cloudflare still needs to form a proper foundation, and the entry point for that foundation could be 116.

Aggressive investors could watch for an early entry to the March 21 high of 100.90 if Cloudflare regains that level.

Launched in 2009, Cloudflare accelerates and provides security for web applications routed through an intelligent global network.

Revenue in 2023 increased 33% to $1.296 billion. Analysts surveyed by FactSet expect sales to rise 28% to $1.654 billion in 2024. Additionally, Cloudflare has set a long-term goal of $5 billion in annual recurring revenue (ARR) from its subscription-based services.

Hires new chief strategy officer

In news, Cloudflare hired longtime Goldman Sachs banker Stephanie Cohen as chief strategy officer in mid-March.

“Cloudflare's core markets, product portfolio and management team have been significantly upgraded,” Oppenheimer analyst Tim Horan said in a recent report. “Cloudflare's new head of sales should help the company realize (significant) improvement with the acquisition of a new logo. The company continues to add impressive new talent.”

Generative AI has been a hot topic for investors since the arrival of ChatGPT maker OpenAI in late 2022. Additionally, Cloudflare has a relationship with OpenAI. Cloudflare provides a secure link to its cloud service when consumers sign up to use ChatGPT, a conversational chatbot.

Cloudflare also increases investment in AI infrastructure in partnership with chipmakers Nvidia (NVDA).

Cloudflare and competitors Akamai Technologies (AKAM) is rushing to deploy network gear to support edge computing, extending cloud services closer to where data is generated. At the same time, Cloudflare is targeting AI “inference,” or processing AI apps and workloads locally on the network edge.

Cloudflare Stock: Nvidia Partnership

Cloudflare told analysts it plans to deploy Nvidia AI chips in 300 cities by the end of 2024. The AI networking card simply plugs into a PCI slot in a computer server, reducing the need for capital investment.

In late September, Cloudflare announced a partnership with the Workers AI platform. microsoft (MSFT), private Databricks and Hugging Face. Hugging Face is one of a wave of AI startups building AI training models for apps.

“The company is unique in that it bundles networking, security, compute, and now AI all on one edge platform,” Horan added. “Having your own global AI infrastructure will benefit you at this time of expected scarcity. Increased inference will accentuate the latency of many applications, resulting in AI moving closer to the edge. Masu.”

Cloudflare stock technical evaluation

Meanwhile, Cloudflare stock has an IBD Composite Rating of 94, according to IBD Stock Checkup.

The IBD Comprehensive Rating combines five separate unique ratings into one easy-to-use rating. The best growth stocks have an overall rating of 90 or higher.

Additionally, Cloudflare stock has a cumulative/distribution rating of B. This rating analyzes changes in a stock's price and volume over the past 13 trading weeks. Current ratings indicate that there are more funds buying than selling.

This rating measures the buying and selling of a stock by institutional investors on a scale from A+ to E. A+ means large purchases by institutional investors. E means bulk sale. Consider a C grade to be neutral.

Cloudflare's earnings for the quarter ended Dec. 31 were 15 cents per share, up 150% from 6 cents a share in the year-ago period. The San Francisco-based company said sales rose 32% to $362.5 million.

Analysts expected adjusted earnings of 12 cents a share and revenue of $353 million.

Follow Reinhard Klaus on X (formerly Twitter). @reinhardtk_tech Get the latest information on artificial intelligence, cybersecurity, and cloud computing.

You may also like:

IBD Digital: Get access to IBD's premium stock lists, tools and analysis now

Learn how to time the market with IBD's ETF Market Strategy

IBD Live: A new tool for daily stock market analysis

Want to make quick profits and avoid big losses? Try SwingTrader