(Bloomberg) At no point this week did oil futures trade above levels last Friday, before the Iranian attack on Israel.

Most Read Articles on Bloomberg

And while prices rose again this Friday on reports that Israel had fought back, futures ultimately fell to close little changed. This is a sign that traders are betting, at least for now, that tensions in the region won't escalate into a conflict that could cut off global oil supplies anytime soon.

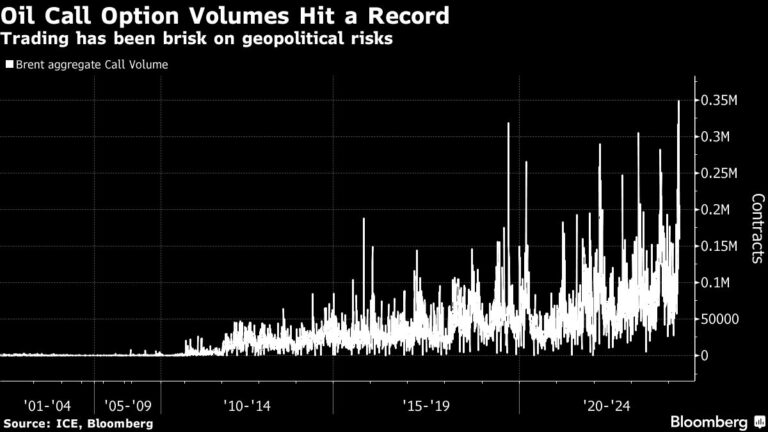

However, that's only one side of the story. Intraday prices have seen their biggest swings in months, with speculators in the options market piling in contracts at a record pace to profit from the surge in futures prices.

Read more: Popular oil trading loses favor as war risks haunt markets

All of this points to an oil market that is optimistic about short-term disruptions, but also one where perceptions can change rapidly.

Jorge Leon, an analyst at consultancy Rystad Energy, said: “It's difficult to assess whether this is a temporary selloff or the beginning of a new escalation in the conflict between Iran and Israel, but the early market “The reactions suggest that the former is more likely.” .

Risks to oil are starting to gain global attention, even as the benchmark Brent price hovers between $85 and $90 per barrel. A senior official from the International Monetary Fund warned on Friday that a severe oil shock could occur.

Traders are now entering the options market one after another. There, you can buy insurance relatively cheaply to protect yourself from rising prices, and even get your property back.

Bullish Brent call options trading soared to record levels this week. Such contracts still hold a hefty premium over bearish puts, but that has declined in recent days. That's a sign of a market where people are shielding themselves from a rebound.

The total amount of bullish call options on Brent held by traders is the highest since 2020, with more calls with a strike price of $110 over the next 12 months than any other contract. Some calls have strike prices above $150, indicating that some market participants are betting on, or protecting against, a rise in oil prices that will exceed even the surge that followed Russia's invasion of Ukraine. It is shown that.

“The problem with geopolitical challenges is that you have to think a lot about tail risks,” Nathan Sheets, global chief economist at Citigroup, said in an interview on Bloomberg TV. “The key question is, what is the market focused on? What is the impact of this on oil supply?”

Oil prices were stable even before the situation in the Middle East worsened. The Organization of the Petroleum Exporting Countries and its allies have kept about 2 million barrels a day of supply off the market, and analysts have generally raised their forecasts for global consumption this year.

But the oil market's reaction this week has been somewhat lackluster, coming amid signs that demand is softening. Premiums for fuels such as diesel and naphtha have eased, and prices for some real-world crude grades are no longer as high as they were a month ago.

Another factor keeping prices down is the relatively large buffer of spare capacity, thanks to the very cuts that OPEC+ is implementing. The International Energy Agency warned last week that the group could soon have one of its largest supply buffers in history as production from outside the group continues to expand. This puts a limit on how high prices can go.

But for now, oil prices are soaring.

Brent futures were in their biggest intraday range since November on Friday, with traders looking to see what Israel and Iran would do next as they entered the weekend much like they did a week ago.

Gita Gopinath, First Deputy Managing Director of the International Monetary Fund, said: “A serious escalation would mean a much broader regional escalation than we have seen to date; There is a possibility of an oil shock occurring.” Bloomberg TV. “But we're not there yet.”

–With assistance from Devika Krishna Kumar.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP