Advances in artificial intelligence (AI) are progressing rapidly, and it is becoming increasingly difficult to imagine a world where this technology does not impact nearly every aspect of daily life.

While much of the buzz around AI revolves around areas like accelerated computing and healthcare, there's another use case that intrigued me. Integrating artificial intelligence into a company's workforce represents a unique and attractive long-term opportunity.

Ark Invest CEO Cathie Wood declared that AI software has the ability to significantly improve productivity in the workplace. In a recent report, Wood suggested that AI automation software could become a $13 trillion market by 2030.

Believe it or not, many companies are focusing on creating more efficient work environments through the power of technology. UiPath (NYSE:Pass) is a leading company in AI-powered automation tools, and I think it could be the best investment option in this area of the AI space.

Let's analyze how AI can redefine workplace dynamics and assess why UiPath is an attractive long-term opportunity.

Workplace productivity is ripe for destruction

Streamlining basic tasks is not a new idea. In many cases, technology has been the key to realizing these benefits.

In Ark Invest's Big Ideas 2024 report, Wood shares some interesting case studies related to robotics and how robots have enhanced the completion of routine and managerial aspects of work. Masu.

For example, Wood says that with the advent of washing machines, the average time it takes to do laundry has been reduced by 87%. Similarly, integrating assembly lines into factories has significantly reduced the time required to manufacture cars.

These ideas have been applied in the workplace for decades. For example, sales and marketing leaders have relied on customer relationship management (CRM) tools such as: sales force For many years.

In addition, enterprise resource planning (ERP) suites SAP and oracle has helped some of the world's largest companies with financial aggregation, business metrics analysis, and more.

According to Wood, the average worker's productivity could increase by 4.5 times by automating tasks through artificial intelligence. Wood claims that if his vendors captured just 10% of the potential software productivity gains, these companies together could earn him $13 trillion in revenue. I am.

This scenario suggests that UiPath has greenfield opportunities related to the intersection of AI and workplace productivity. Let's take a look at the company's actual performance and how it compares to its competitors.

UiPath leads the way

UiPath operates in the robotic process automation (RPA) market. Essentially, the company's software helps automate administrative tasks and expedite workflow processes.

UiPath shut down its service last year after more than 2,000 customers spent at least $100,000 a year on its platform. Additionally, UiPath has increased the number of customers spending more than $1 million annually on its suite of software by 26% year over year. This highlights UiPath's deep penetration into both small and medium-sized enterprises (SMEs) and large enterprise accounts.

The accelerated adoption by customers is not entirely surprising given how much demand for AI has grown over the past year. The company's sales last year increased 24% to $1.3 billion. Meanwhile, adjusted free cash flow was $309 million. In comparison, the company essentially reached breakeven on a free cash flow basis last year.

With a great partner ecosystem including SAP, IBM, AccenturePwC, Deloitte, and UiPath, I think the growth story is just beginning.

Persuasive evaluation explanation

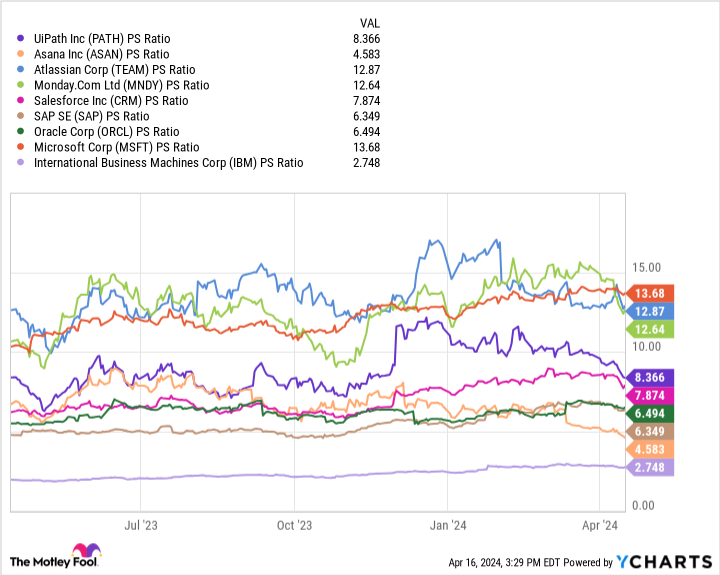

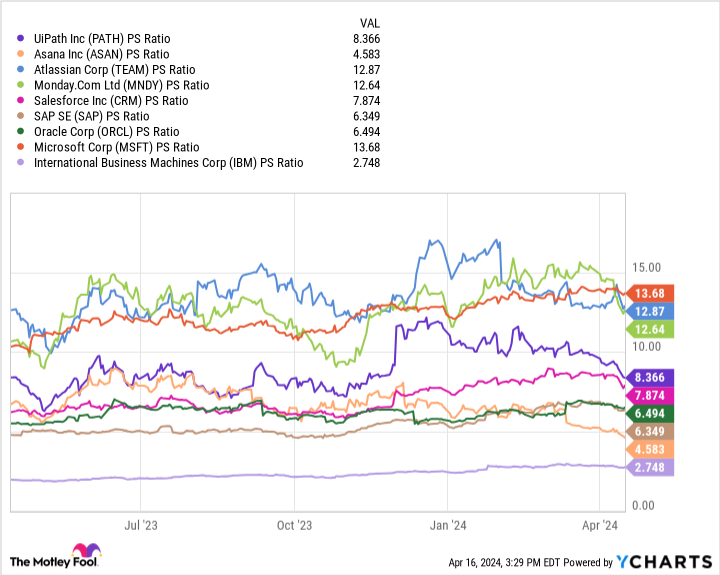

The chart below benchmarks UiPath against other enterprise software platforms offering workplace productivity solutions. With a price-to-sales (P/S) ratio of 8.4, investors can see that his UiPath sits right in the middle of this peer set.

What I found most interesting about the above analysis is that UiPath is valued similarly to the large technology companies operating in the RPA space. microsoft That's the only exception. Given the success Microsoft has demonstrated through his CoPilot platform, it's not at all surprising that it trades at such a notable premium among this peer group.

Keep in mind that UiPath ended last year with approximately $2 billion in cash and equivalents on its balance sheet. Although the company has positive cash flow, one thing to consider is how to allocate the company's resources. To compete at scale with big tech companies, UiPath will need to increase spending.

It will affect the company's bottom line, but it could be a worthwhile strategy. I am optimistic about the efficiencies that AI will bring to the workplace in the long term and agree with Wood's theory that the market opportunity is huge.

So far, UiPath has proven that it can compete with large and well-capitalized companies in the RPA market. Given how quickly AI is impacting other important end markets, I think it will be sooner rather than later that this technology begins to have a profound impact on the workplace.

As productivity becomes more of a focus for companies of all sizes, we think now is a good time to consider acquiring UiPath stock.

Should you invest $1,000 in UiPath now?

Before buying stocks on UiPath, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Things investors can buy right now…and UiPath wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

when to think about it Nvidia This list was created on April 15, 2005…if you invested $1,000 at the time of recommendation. you have $466,882!*

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor For the service more than 4 times The resurgence of the S&P 500 since 2002*.

See 10 stocks »

*Stock Advisor will return as of April 15, 2024

Adam Spatacco has a position at Microsoft. The Motley Fool recommends Accenture Plc, Asana, Atlassian, Microsoft, Monday.com, Oracle, Salesforce, and he has positions in UiPath. The Motley Fool recommends International Business Machines and recommends the following options: A January 2025 $290 long call on Accenture Plc, a January 2026 long $395 call on Microsoft, a January 2025 $310 short call on Accenture Plc, and a January 2026 $405 short call on Microsoft. The Motley Fool has a disclosure policy.

According to Cathie Wood, artificial intelligence (AI) productivity tools could become a $13 trillion market. One stock that could be dominant is:Originally published by The Motley Fool