A colleague recently asked me to calculate the annual returns for U.S. stocks, bonds, and cash over 30 years.

He just wanted something in return. He couldn't help but slice and dice the numbers and overanalyze the data. Because that's what we're doing here.

Let's dig deeper.

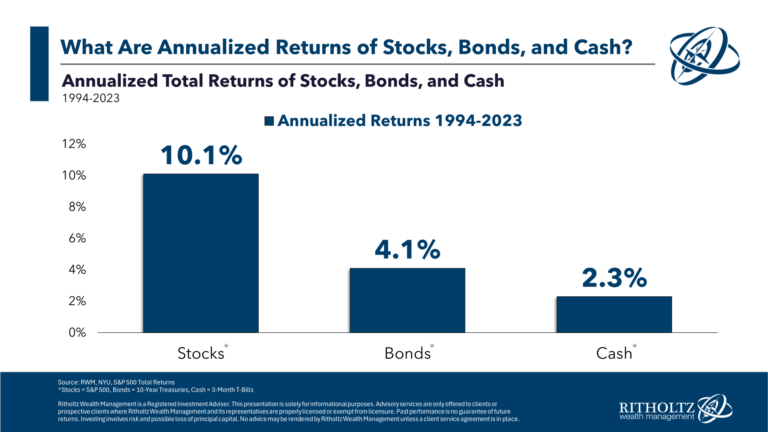

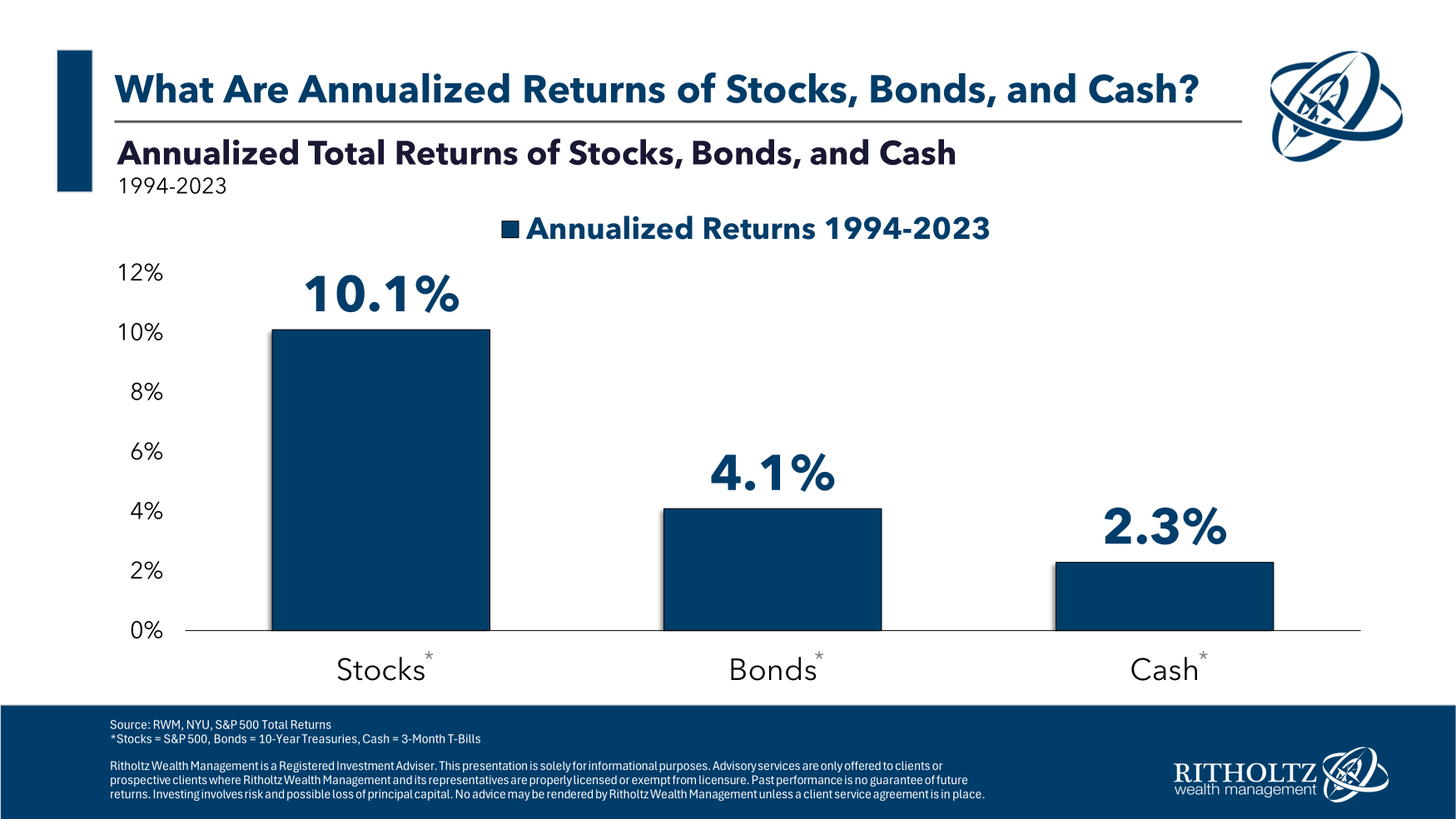

First, the annual returns for the S&P 500, 10-year Treasuries, and 3-month Treasuries over the 30-year period ending in 2023 are:

Here are some thoughts on these numbers:

Despite the turmoil, the price-to-earnings ratio is average. From 1994 to 2023, the dot-com bubble, the 50% crash, 9/11, the housing bubble, the Great Financial Crisis (which led to another 50%+ crash), several wars, three recessions, and a pandemic.

And yet…the stock market rose 10% for the year.

There were booms and busts, ups and downs, good times and bad, but things still worked out.

There are no guarantees about the future, but it's still pretty impressive.

Despite the bear market, bond returns weren't bad. Government bond yields have been below average for some time. We are still in the midst of the worst bond bear market in history.

In 2022 and 2023, 10-year U.S. Treasuries fell a combined 22%.1

The five worst calendar year returns for U.S. government bonds since 1928 have all occurred in the past 30 years. Three of his five years of this have occurred since 2009.

Starting yields were high in the mid-1990s.2 Lower interest rates helped, especially during the first decade of this century.

But a 4% return isn't bad considering how strange the yield situation has been over the past 15 years or so.

Even though the yield was 0% for a very long time, the cash return was significant. Given that inflation was 2.5% per year over the 30 years up to 2023, the return on Treasury bills of just over 2% per year is not very good.

Over half of the last 30 years (16 years) the return was less than 2%. There have been 11 calendar year returns of less than 1%.

But now the yield on Treasury bills is over 5%.

We don't know how long that will last, but (for now) it means the returns are much higher than they have been in recent years.

In fact, the outlook for both cash and bonds is in much better shape than they have been in the past.

Here are some other quick stats:

- Stocks have increased 80% over the past 30 years. The stock market has had four double-digit declines, but has had double-digit gains 19 times over the last 30 years. The S&P 500 index rose more than 20% four times in his 10 years. The highest annual return was +37%. The worst annual return was -37%.

- Bonds have risen 80% over the past 30 years. The bond market has had two double-digit declines (in 2022 and 2009) and nine years of double-digit gains. The highest annual return was +24%. The worst annual return was -18%.

- Cash never had a negative (nominal) year, but the annual return was also the worst in 30 years. The best annual return was +6%, while the worst was 0%.

We don't know what will happen in the next 30 years, maybe a recession, a bear market, a geopolitical crisis, a war, maybe an epidemic, and who knows what else.

But I know that do not have Investing your money is guaranteed to keep up with inflation.

And I feel the risk is rewarded with higher returns.

However, we don't know exactly what that return will be.

If there were no risks, they would not be called risky assets.

References:

Historical returns for stocks, bonds, and cash

1This means that the yield is also included.

2About 6% towards 1994.

This content, including security-related opinions and information, is provided for informational purposes only and should not be relied upon in any way as professional advice or as a recommendation of practices, products, or services. There are no guarantees or warranties that the views expressed herein will apply to any particular facts or circumstances, and they should not be relied upon in any way. You should consult your own advisor regarding legal, business, tax, and other related matters regarding investments.

Comments in this Post (including associated blogs, podcasts, videos, and social media) reflect the personal opinions, perspectives, and analysis of the Ritholtz Wealth Management employee who provided the comments; They should not be interpreted as the views of Ritholtz Wealth. As a description of the performance returns of clients of Management LLC or its affiliates or of advisory services provided by Ritholtz Wealth Management or Ritholtz Wealth Management Investments.

References to securities, digital assets, or performance data are for illustrative purposes only and do not constitute an investment recommendation or the provision of investment advisory services. Charts and graphs provided herein are for informational purposes only and should not be relied upon when making investment decisions. Past performance is not indicative of future results. Content speaks only as of the date indicated. The forecasts, estimates, projections, objectives, prospects and/or opinions expressed in these materials are subject to change without notice and may differ from or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payments from various entities for associated podcast, blog, and email advertising. The inclusion of such advertisements does not constitute or imply endorsement, sponsorship, or recommendation of such advertisements by, or any affiliation with, the content creator, Ritholtz Wealth Management, or their employees. Investing in securities involves risk of loss. For additional advertising disclaimers, see: https://www.ritholtzwealth.com/advertising-disclaimers

Please see our disclosure here.