Please give me McDonald's (New York Stock Exchange:MCD) some degree of trust. You can see which side of the Big Mac Bun has the special sauce on it. We also offer a new digital marketing fund to improve access to mobile his business, with particular emphasis on franchisees. However, investors were a little skeptical, and the stock fell slightly in afternoon trading on Thursday.

McDonald's has been working to expand its online business for some time, with a particular focus on mobile apps. And now, the company is putting money toward that goal by offering its franchisees access to the aforementioned digital marketing fund, which will reportedly revamp the company's marketing and market The company is said to be moving to further increase its dominance in the market. The fund will have “hundreds of millions of dollars” in investments over the next few years, and will also include some amendments, according to the report. One particularly anticipated change is the ability to order online as well as through the mobile His app.

You can also order more

While changing your marketing strategy may be a good move, it certainly doesn't hurt to have something new to promote. And McDonald's is working on that too. A while back, McDonald's announced that they would be increasing their portion sizes and also offering larger burger options. All's well, but McDonald's is taking it a step further by announcing it's also releasing an even bigger option. Customers are feeling the effects of inflation and shrinkflation alike, but McDonald's move to scale is exactly what the company needs to attract attention, and marketing programs may be able to capitalize on that. There is.

What will the future hold for McDonald's stock?

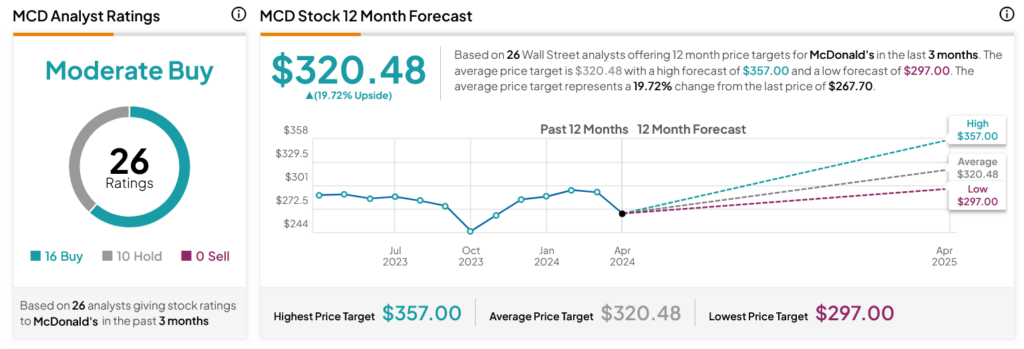

Turning to Wall Street, analysts have given MCD stock a consensus rating of Moderate Buy, based on 16 buys and 10 holds assigned over the past three months, as shown in the chart below. ”. Over the past year, the company's stock has declined by 7.76%, while MCD's average price target of $320.48 per share means it has a 19.72% upside potential.

disclosure