USDA’s May Global Agricultural Supply and Demand Estimates This report is the first to present the demand and supply balance sheet for the new fiscal year. However, with planting still underway in the Northern Hemisphere and old crops still being harvested in the Southern Hemisphere, forecasts at the beginning of the year are highly uncertain and the focus is on forecasting ending stock levels.

For domestic 2024/25 crops, which are currently being planted in most parts of the country, supply forecasts for most crops are based on farmers' planting decisions from the March planting schedule report and yield trend models. Masu. The projections in this WASDE report do not take into account delays in planting progress due to wet conditions in the Midwest.future U.S. production projections could be reduced if planting is delayed.

corn

The USDA projects U.S. corn ending stocks for 2024/25 to be 2.102 billion bushels, an increase of 4% (80 million bushels) from 2023/24. Current new crop corn forecasts were below industry expectations and nearly 17% below USDA Agricultural Outlook Forum estimates. During February. Due to the weak domestic market, USDA projects average market prices to decline 5.4% from 2023/24 to $4.40 per bushel. Globally, corn ending stocks are expected to remain stable in 2024/25, with a decline of only 0.3% due to lower production.

Overall, the 2024/25 corn market looks less bearish than it was when farmers made planting decisions months in advance. The USDA increased corn demand (total usage) for old and new crops by 100 million bushels each. Total usage in 2024/25 is projected to be 14.8 billion bushels, an increase of 1.1 billion bushels compared to 2022/23 and a near record level of 14.9 billion bushels set in 2021/22. i will be back. December corn futures responded with positive follow-through on Monday, May 13th, rising 11 cents.

soy

While the corn market looks less bearish in 2024/25, the opposite is true for soybeans. U.S. soybean ending stocks for the next marketing year are projected to be 445 million bushels, which exceeds both trade forecasts and the USDA Agricultural Outlook Forum. Forecast for February. Compared to his current 2023/24 marketing year, this equates to an impressive 30.8% increase for him. Because of this expected large price increase, USDA projects prices to fall to $11.20 per bushel, down 10.8% from a year ago.

Globally, soybean ending stocks are in a similar but more stable position, with forecasts for them to increase by 15% year-on-year to 128.5 million tonnes (MMT). Brazil's production is forecast to increase by 15MMT (9.7%) to 169MMT in 2024/25, and Brazil's exports are forecast to increase by 3MMT (2.9%) to 105MMT.

Soybean estimates are highly dependent on continued increases in soybean usage, with both crushed and export volumes increasing by an estimated 125 million bushels, representing increases of 5.4% and 7.4%, respectively . If demand for soybeans does not remain strong, it could quickly turn bearish.

wheat

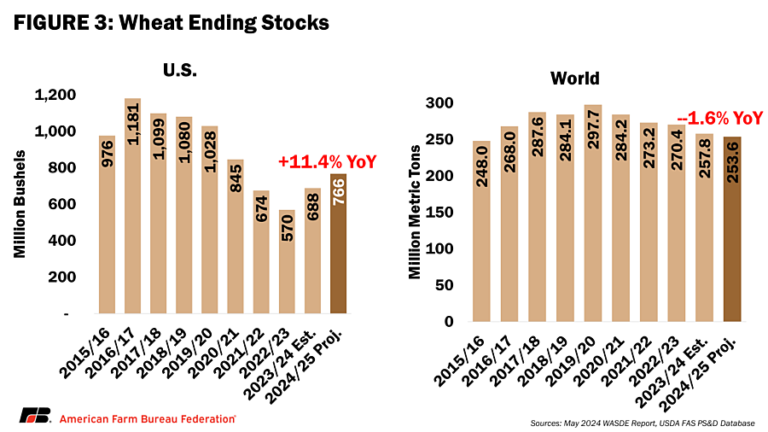

Wheat is a bright spot in the report, with global markets predicted to tighten in 2024/25. Domestically, ending stocks are projected to increase 11.4% to 766 million bushels based on increased production (+2.5%) due to improved growing conditions. Domestic production is projected to increase in 2024/25, but the ratio of winter wheat harvested area to planted area will still be the eighth lowest. The situation is more optimistic when compared to 2023 (second lowest on record) and 2022 (fourth lowest on record).

The USDA forecasts that global wheat ending stocks will be the lowest in eight years, down 1.6% from a year ago to 253.6 MMT. Despite tight global markets, average farm prices for US wheat are projected to fall to $6.00, a 15.5% decline from the 2023/24 market year.

cotton

Cotton ending stocks for 2024/25 are forecast to increase by more than 50% domestically to 3,700,480 lb bales and by 3.1% globally to 253,600,480 lb bales. The significant increase in domestic ending stocks is due to a projected 32.6% increase in production. Despite the large increase in supply, average farm prices for upland cotton are projected to decline by only 2 cents per pound (2.6%).

Cconclusion

The 2024/25 planting year is expected to see lower average farm prices for all nine row crops from prices reported in the May 2024 WASDE. This includes medium/short grain rice (-16%), wheat (-15%), barley (-14%), soybean (-13%), sorghum (-11%), and long grain rice (-10%). %), oats (-10%), corn (-8%), cotton (-3%). Although there was some better-than-expected good news in the May 2024 WASDE, particularly for corn and wheat, overall price declines support pessimism in agricultural countries..