In the fast-paced field of digital marketing, where there are numerous partnerships and affiliate programs, strict regulation is essential. Brokers and promoters must balance compliance with maximizing promotion and dealing with complex liability situations. While compliance may seem like a barrier to some, it is important to emphasize that it is a facilitator that allows businesses to effectively manage consumer expectations and build trust within their target audience. .

First, it is important to clarify the distinction between marketing partners and affiliates. Marketing partners often include a variety of collaborations, including agencies, influencers, and strategic alliances. They typically have a more direct relationship with the brand and are more involved in marketing strategies and campaigns. An affiliate, on the other hand, is an individual or organization that promotes a product or service for a commission. They operate independently and leverage a variety of marketing channels to drive traffic and conversions.

Marketing Partner Main Responsibilities

Marketing partners play a critical role in maintaining brand integrity and compliance by adhering to brand guidelines, mitigating risks associated with promoting financial products and services, and prioritizing consumer protection. . This includes aligning strategy with brand values and guidelines, assessing and minimizing potential legal, reputational and financial risks, and providing accurate and transparent information to consumers. and empowering consumers to make informed decisions that prioritize their own interests.

Affiliates promote products and services ethically and transparently, abide by affiliate program terms and conditions, prioritize quality traffic generation over volume traffic generation, and comply with data protection laws that respect users. This plays a vital role in increasing brand awareness and driving conversions. Protect privacy and treat customer data responsibly.

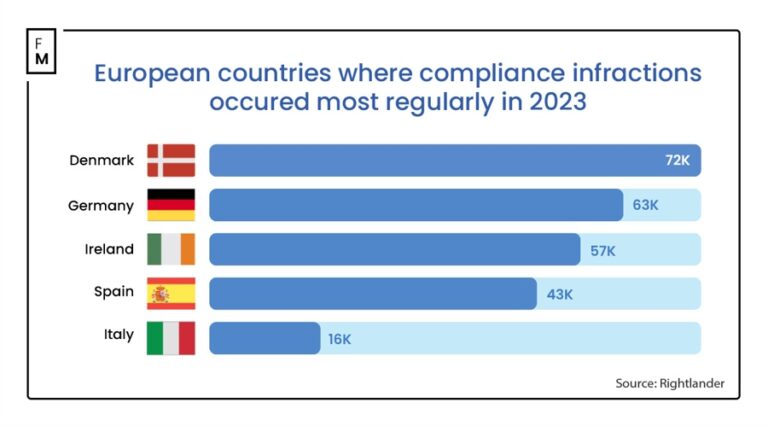

Lightlander scans over the past two years have highlighted the critical need for vigilance in marketing practices. A prominent trading affiliate lured readers with the promise that he would earn thousands of dollars with just a $10 deposit while endorsing reputable financial brands. However, this page does not include the required risk warning and violates multiple her CAP codes intended to maintain marketing integrity.

Around 8,600 ads on Instagram, YouTube and Facebook that promised quick and easy profits and guaranteed profits were blocked or scrutinized by Britain's financial watchdog in 2022. . Furthermore, in 2023, the Financial Conduct Authority (FCA) urged the withdrawal or change of these advertisements. 10,000 financial ads and other promotional materials, an increase of 17% year-on-year.

Additionally, the FCA issued 2,285 warnings to protect consumers from deceptive schemes, a marked increase from the 1,800 warnings issued in 2022, and increased regulatory oversight. This reflects the imperative for stronger compliance within the industry.

Benefits of automated tools for marketing compliance

Automated compliance tools offer significant benefits for brands and their marketing partners in achieving regulatory compliance. These tools streamline the monitoring process, improving efficiency and accuracy by instantly flagging potential violations and reducing the need for manual monitoring.

Real-time monitoring capabilities enable quick response to compliance issues, while customizable features allow you to meet individual brand requirements. Scalability As your business expands. Additionally, automated tools proactively identify and address compliance risks, effectively mitigating potential regulatory penalties and brand reputation damage.

In conclusion, the compliance responsibilities of brokers, marketing promoters, and affiliates may seem daunting, but they are essential to maintaining trust and credibility in the marketplace. By adopting automated compliance solutions, businesses can navigate this situation more effectively, reducing manual pressure on their teams while adhering to regulatory standards.

Compliance should not be seen as a barrier, but rather as a catalyst that increases consumer trust, fosters brand loyalty, and fosters sustainable growth in a competitive digital ecosystem.

In the fast-paced field of digital marketing, where there are numerous partnerships and affiliate programs, strict regulation is essential. Brokers and promoters must balance compliance with maximizing promotion and dealing with complex liability situations. While compliance may seem like a barrier to some, it is important to emphasize that it is a facilitator that allows businesses to effectively manage consumer expectations and build trust within their target audience. .

First, it is important to clarify the distinction between marketing partners and affiliates. Marketing partners often include a variety of collaborations, including agencies, influencers, and strategic alliances. They typically have a more direct relationship with the brand and are more involved in marketing strategies and campaigns. An affiliate, on the other hand, is a person or organization who promotes a product or service for a commission. They operate independently and leverage a variety of marketing channels to drive traffic and conversions.

Marketing Partner Main Responsibilities

Marketing partners play a critical role in maintaining brand integrity and compliance by adhering to brand guidelines, mitigating risks associated with promoting financial products and services, and prioritizing consumer protection. . This includes aligning strategy with brand values and guidelines, assessing and minimizing potential legal, reputational, and financial risks, and providing accurate and transparent information to consumers. and empowering consumers to make informed decisions that prioritize their own interests.

Affiliates promote products and services ethically and transparently, abide by affiliate program terms and conditions, prioritize quality traffic generation over volume traffic generation, and comply with data protection laws that respect users. This plays a vital role in increasing brand awareness and driving conversions. Protect privacy and treat customer data responsibly.

Lightlander scans over the past two years have highlighted the critical need for vigilance in marketing practices. A prominent trading affiliate lured readers with the promise that he would earn thousands of dollars with just a $10 deposit while endorsing reputable financial brands. However, this page does not include the required risk warning and violates multiple her CAP codes intended to maintain marketing integrity.

Around 8,600 ads on Instagram, YouTube and Facebook that promised quick and easy profits and guaranteed profits were blocked or scrutinized by Britain's financial watchdog in 2022. . Furthermore, in 2023, the Financial Conduct Authority (FCA) urged the withdrawal or change of these advertisements. 10,000 financial ads and other promotional materials, an increase of 17% year-on-year.

Additionally, the FCA issued 2,285 warnings to protect consumers from deceptive schemes, a notable increase from the 1,800 warnings issued in 2022, and increased regulatory oversight. This reflects the imperative for stronger compliance within the industry.

Benefits of automated tools for marketing compliance

Automated compliance tools offer significant benefits for brands and their marketing partners in achieving regulatory compliance. These tools streamline the monitoring process, improving efficiency and accuracy by instantly flagging potential violations and reducing the need for manual monitoring.

Real-time monitoring capabilities enable quick response to compliance issues, while customizable features allow you to meet individual brand requirements. Scalability As your business expands. Additionally, automated tools proactively identify and address compliance risks, effectively mitigating potential regulatory penalties and brand reputation damage.

In conclusion, the compliance responsibilities of brokers, marketing promoters, and affiliates may seem daunting, but they are essential to maintaining trust and credibility in the marketplace. By adopting automated compliance solutions, businesses can navigate this situation more effectively, reducing manual pressure on their teams while adhering to regulatory standards.

Compliance should not be seen as a barrier, but rather as a catalyst that increases consumer trust, fosters brand loyalty, and fosters sustainable growth in a competitive digital ecosystem.