“Sell in May and walk away” is a well-worn adage on Wall Street that gained traction last week as stocks hit new all-time highs. This seasonal trend could also be helpful near Main Street.

Of course, most farmers can't sell their corn and soybeans and head to the Hamptons for the summer. However, taking advantage of the late spring bull market to price remaining old crop stocks and expected production this fall helps manage risk in case of market disruption in the coming months. That's one way.

Indeed, average prices tend to peak in June or July, when a threatening La Niña event is expected to occur in 2024. But there's at least a one-in-three chance of a May bull market, and sometimes more.

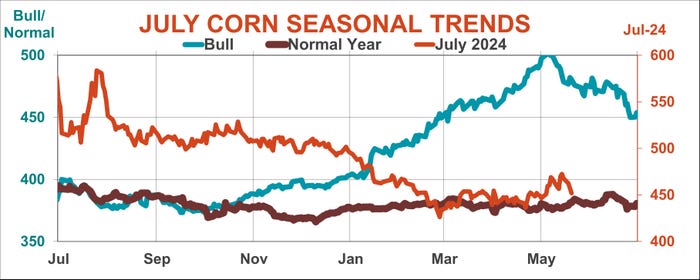

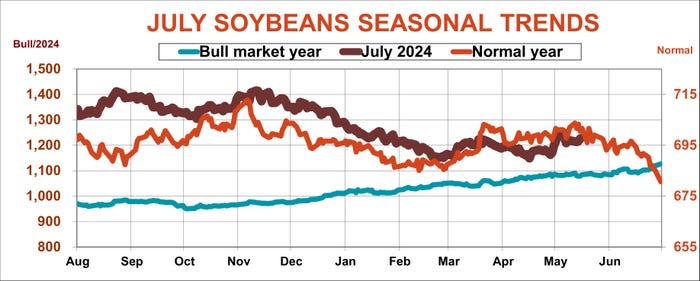

Time may be running out, especially for older crops. July corn futures prices tend to decline after May with a 40% probability, but for July soybeans, May is a good time to buy at least once every two years.

New prices also face risks, one of the reasons being agricultural futures Long-term consideration of sales strategy We have discovered three times when pre-harvest hedging is effective.

-

Second week of April and mid-May for both crops

Corn and soybeans start to rebound

As expected, corn and soybean futures were volatile last week after rising in early May. Both appeared to be losing the grip on their rallying coattails.

Corn returned to profitability, boosted by three factors:

Rice planting progress is slower than usual

How quickly or slowly farmers plant corn is a question every year, affecting the prices of both old and new crops.

Older crops could benefit if farmers are too busy in the fields to move inventory to town and end users must bid local cash prices or purchase July futures instead There is a gender. So even though futures prices on average peak in the last week of June before delivery, prices in June have fallen more than 40% over the past 50 years.

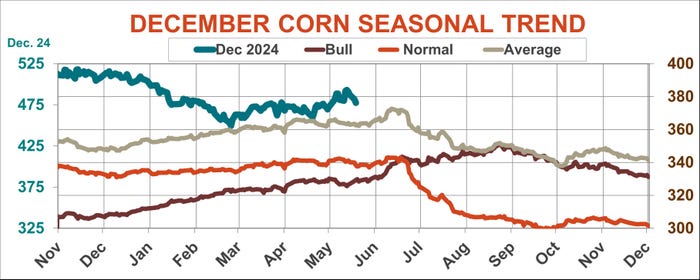

Planting speed has a more direct impact on December futures. Planting progress in mid-May is based on USDA methodology for “normal” trend yields, which is statistically created to predict supply by the time the USDA surveys farmers and their fields in August. This is an important variable. A May 15 date is set in the record books for 2024, and slightly below-average speeds would bring expected yields slightly below the 181 bushels per acre figure the USDA has been using this year since last fall. There is a possibility that it will decrease. Still, the situation in June and July is far more important in determining yield to maturity.

USDA Friendly Report May 10

Global agricultural supply and demand estimates can impact markets every month, and May's print edition was no exception. In addition to updating numbers for old crops, the May report featured the agency's first monthly forecast for new crops.

Usually, this is simply a reminder that supply is sufficient unless growing weather intervenes, and is a good reason for the market to exit.

This year's edition projects surplus supply at 2.1 billion bushels at the end of the next marketing year, August 31, 2025, which is by no means a bullish number. However, due to bullish developments, the price fell below trading expectations. The USDA lowered its 2023-2024 emissions projections by 100 million bushels lower than expected, and the reductions were rolled over to 2024-2025. As a result, both old and new agricultural futures rose by about a day.

Wheat prices rise to highest level since last summer's harvest

Nearby Chicago flirted with $7 before retreating, giving momentum to the corn. USDA wheat numbers were slightly bullish, with production and expected carryout coming in below expectations. But the real news came from abroad, from Russia to Ukraine to Europe, where weather and war have had a huge impact on crops. The USDA predicts global stock prices will fall to their lowest levels since 2015-2016, with futures falling just short of testing $4 before hitting a long-term low.

That reignited early hopes that wheat, which has fallen an astounding 60% from its post-pandemic 2022 highs, could rally again, and corn also rose.

Wheat and corn can be complex dance partners. Cheap coarse grains reduce wheat intake and vice versa, but what is good for the goose may also be good for the gander.

soy spirits

Beans gained buoyancy by ignoring seemingly weak numbers from the USDA. After some initial turmoil, futures are now 25-30 cents below their early May highs after a sell-off as traders focused on more positive news and forecasts for increased supply. Stable.

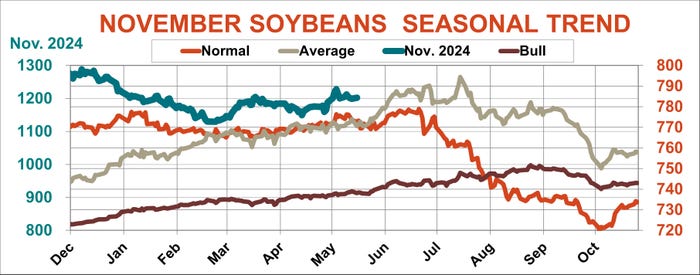

WASDE held its old crop exports steady at 340 million bushels, raising its 2024-2025 bottom line to 445 million bushels, the highest since the start of the trade war. As tensions with the US come and go like a tennis match, China once again commands market attention and becomes the elephant in the room. Although some green shoots have appeared in economic news outside of China, it has long been a bearish factor as China's growth slows due to the failure to control the pandemic and new measures that have also been ineffective. was. However, the rebound in the Chinese stock market after falling nearly 50% from its 2021 highs has been strong enough to create FOMOR (fear of missing out on the bull market) that will push the CSI index to its highest level in 2024. It was a technical signal.

China's soybean imports are still not expected to increase, despite rising expectations for the economy due to an aging population and declining birthrate. Whether the U.S. will increase its share in this business will depend on competition from Brazil. In Brazil, leaders continue to court Chinese investment in exchange for improved political alliances.

Brazil can't sell what it doesn't have, and late-season rains continue to flood the country, but the damage to overall production has been difficult to assess.

Bets on the biodiesel boom were similarly clouded by U.S. politics, where subsidies and mandates could face headwinds, and pressure continued to mount. New U.S. tariffs could also provoke a backlash from Beijing, but the impact appears to be largely rhetoric, not reality.

Progress in reforestation in the United States has been a double-edged sword. A significant delay in corn could prompt a switch to soybeans as plant crop insurance has expired, unless weather interrupts soybean seeding. However, these milestones are still a long way off and do not seem to be a big factor this year.

The average peak for July futures is in June, but old-crop soybean stocks appear to be most at risk. A few large increases skew these averages. Once every two years, futures prices fall during the June delivery period, which is a threat to producers who cannot withstand the downdraft. Also, although price increases for new crops could be explosive, May prices are up nearly 60%, similar to November futures.

dollar dithering

Corn and soybeans also faced headwinds from parts of Wall Street where the melodrama about interest rates took center stage. News on inflation and growth sent mixed signals, sometimes on the same day, and expectations for rate cuts and a weaker dollar remained uncertain at best.

As a result, the dollar declined overall. Betting on federal funds futuresSuch aggressive action from the Fed is asking too much, and the central bank needs to ignore the howls of playing politics with monetary policy that will surely follow.

The Fed's next meeting is scheduled for June 11-12. Action this early remains unlikely unless pressure from allies weighed down by the dollar's weakness convinces U.S. officials that the threat of derailing the global economic recovery is too great to ignore.

The value of the dollar does not directly affect U.S. corn or soybean exports by raising or lowering prices. But it can change a customer's purchasing power and overall financial well-being, which can be a factor.

So, like everything else this spring, the lack of clear signals makes an unpredictable market even more difficult to predict. It's kind of like the weather!