The US stock market is one of the best predictors of whether the incumbent party will win a presidential election.

This is important to know because electronic prediction markets have mixed messages and have been used by many people to obtain reliable predictions. Lately, many fans of these markets have become disillusioned with these mixed messages. For example, a survey of some of the most popular prediction markets earlier this week found that President Joe Biden's chances of being re-elected currently range from less than 38% to as high as 76%, depending on what you look at. It became clear that the range The range is so wide that it is difficult to place emphasis on any one prediction.

Most Read on MarketWatch

What about other economic, financial and sentiment indicators? To find out, I analyzed the U.S. stock market, the economy as measured by real GDP, the Conference Board's Consumer Confidence Index, and the University of Michigan's Consumer Sentiment Survey. In each case, we looked at changes from the beginning of the year as of election day to the present. Only the stock market was significantly correlated with the incumbent party's likelihood of victory (at the 95% confidence level that statisticians often use to determine whether a pattern is real).

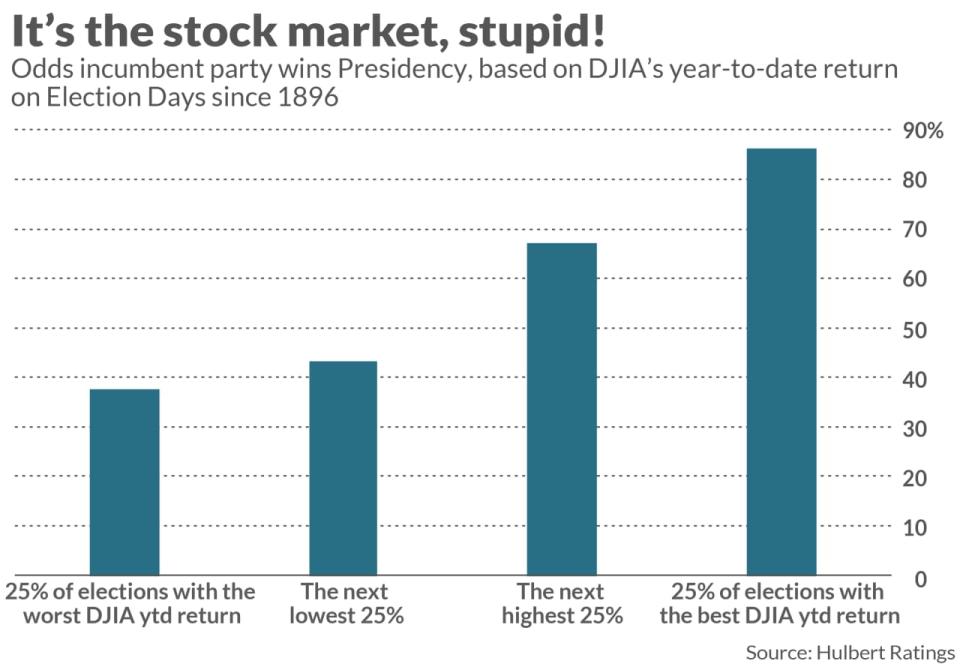

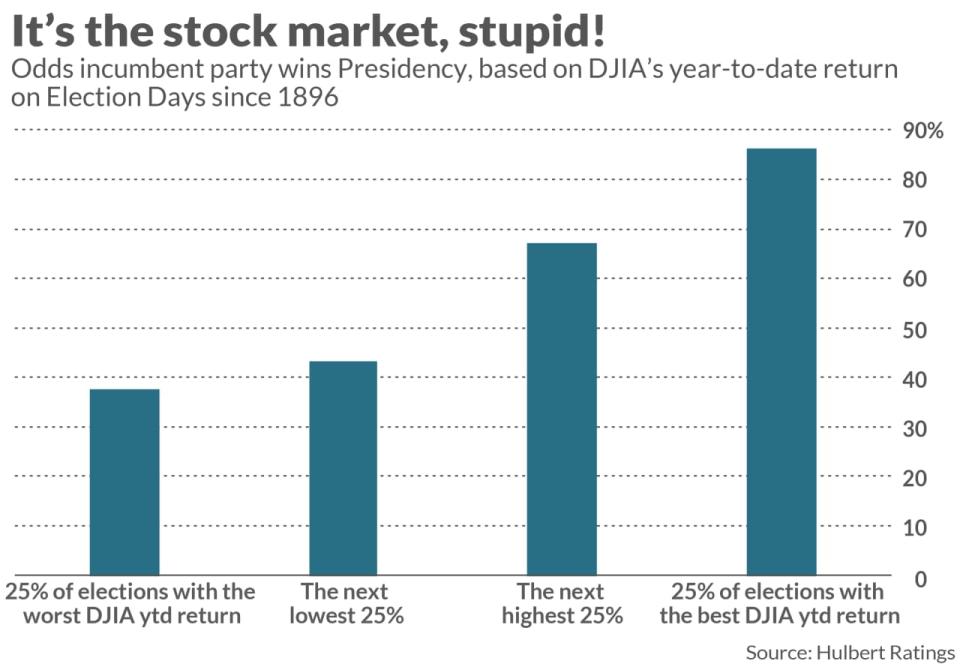

What I found is summarized in the chart below. To construct it, I categorized every Presidential election since the Dow Jones Industrial Average (DJIA) was founded in 1896 into four equal-sized groups based on Election Day year-to-date returns: As you can see, the probability of the incumbent party retaining the White House has increased in lockstep with its year-to-date performance.

Based on historical correlations and the Dow's 5.6% year-to-date stock price gain alone, Biden has a 58.8% chance of being re-elected, which increases if the stock market rises further between now and Election Day and decreases if the market falls.

Even if electronic prediction markets did not send such mixed messages, it would be difficult to show that their track record is better than stock markets. That's because without a large sample, it's very difficult for patterns to meet traditional criteria for statistical significance. For example, one of the oldest financial products of its kind, the Iowa Electronic Market (IEM), was started in his 1988. That means its track record includes just nine presidential elections.

James Carville, an influential strategist for former President Bill Clinton during the 1992 election, famously said, “It's the economy, stupid.” He used the line to remind Clinton campaign staff that all other issues pale in comparison to the economy, which is the determining factor in whether the incumbent party will keep the White House. Perhaps Carville's line should be revised to, “It's the stock market, stupid.”

Mark Hulbert is a regular MarketWatch contributor. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. You can contact him at: .

read:

Stock market rally weakens after strong summer

Are fund managers who outperform the market really talented or just lucky?