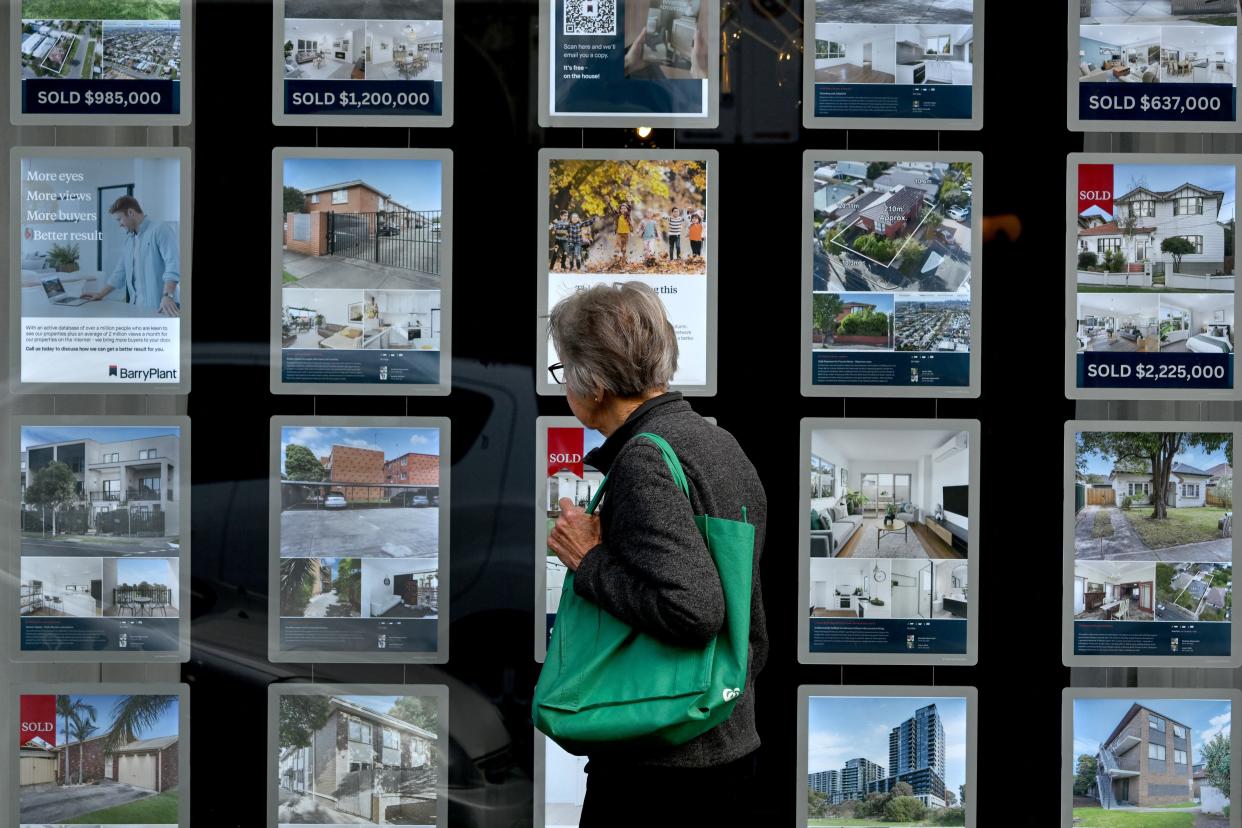

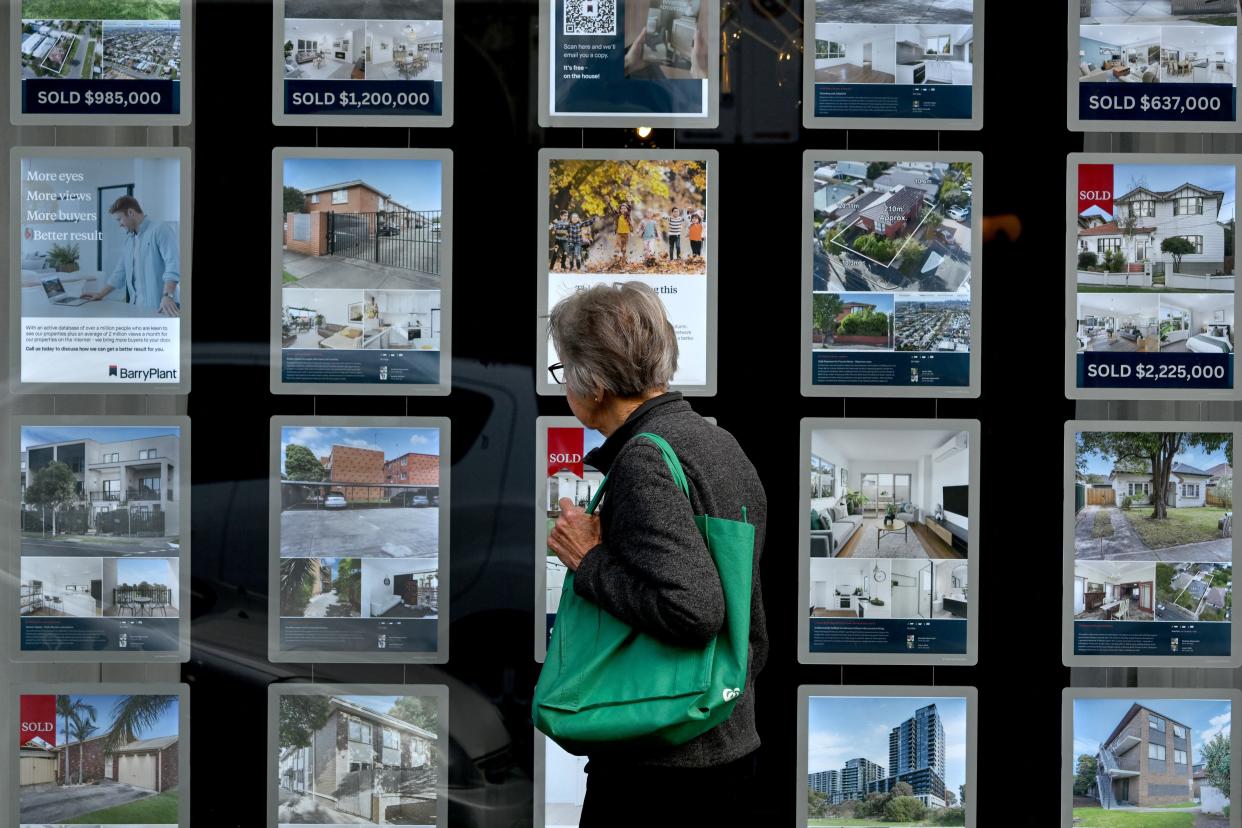

Want to buy a house? If so, we have bad news from Redfin. Homebuyers need to earn 50% more than they did before the pandemic to afford a typical U.S. home in today's market, according to the real estate firm's latest research.

To purchase the median-priced U.S. home in August 2023, buyers nationwide needed an average income of $114,627 (pre-tax, adjusted for inflation), according to Redfin. This is an increase of 15% ($15,285) from a year ago and 50% more than the $72,511 income needed to buy a home in August 2019. According to Redfin, this figure represents the highest annual income required to buy a home on record dating back to 2012. found.

That's a steep jump for some, considering the average annual household income in America in 2022 was about $75,000. Hourly wages have risen only about 5% over the past year, according to the Federal Reserve Bank of Atlanta.

This data shows how unaffordable the housing market has become over the past four years, as home prices and mortgage rates have soared far faster than wage growth, leaving more and more entry-level buyers priced out. It highlights that it has become something that does not exist.

read more: How to buy a house in 2023

“Low mortgage rates made it cheaper to borrow to buy a home, suppressing affordability to some extent. And by 2022 and 2023, mortgage rates have more than doubled from a low of 3% to 8%. %,” which has significantly increased costs. [buying] home,” said Darryl Fairweather, chief economist at Redfin.

read more: Mortgage interest rates are at their highest level in 20 years: Is 2023 a good time to buy a home?

6 figures or busts

You need to earn at least $100,000 a year to buy a home in 50 of the 100 U.S. metropolitan areas analyzed by Redfin, and at least $50,000 to buy a home in the rest of the country. I needed income. Analysts say the year-over-year increase in city-level income needed to buy a home is not adjusted for inflation.

In both Miami and Newark, New Jersey, homebuyers needed to earn 33% more in August than a year ago to afford a median-priced home, more than any other major U.S. city. This was the largest increase rate.

According to Redfin data, a Miami homebuyer needed to earn $143,000 a year to cover the area's typical monthly mortgage payment of $3,580 during the same period. Newark buyers needed an income of about $160,000 to pay an average monthly mortgage of $3,989 in August.

Buyers considering metropolitan areas were in an even tougher situation.

In San Francisco and San Jose, California, people wanting to buy a home needed to have an income of $400,000, according to Redfin. This is an increase of approximately 24% over the previous year. His five most expensive markets were all in California. In Anaheim, I had to make $300,000 a year. Oakland, $250,000. San Diego, $241,000. Los Angeles, $237,281. and Oxnard, $233,000.

In Anaheim alone, the third most expensive market among the metropolitan areas surveyed, the income required to buy a median-priced home rose 28.6% year over year. Those people were looking at monthly payments of $7,500 for a typical $1.1 million home.

And although home prices are softening in some metropolitan areas, the tight inventory of existing homes on the market continues to push prices higher.

The National Association of Realtors predicts that sales of previously owned homes will fall 20% by the end of the year as existing homeowners are reluctant to forgo ultra-low interest rates and move quickly. There is.

Jeffrey Ruben, president of WSFS Mortgage, told Yahoo Finance that “sales may slow further as we get closer to the end of the year.” “I spoke to my guys on the phone and the overall comment is that we're holding out, but we're not seeing a rapid recovery. We're coming out of depressed levels, but we're in a depressing situation. It is continuing”

Bargain area?

Rust Belt homebuyers are earning less than in other metropolitan areas, but they're still making more money than they did a year ago. The Rust Belt region stretches from upstate New York to the Midwest and is known as an industrial region that once flourished in steel and coal production.

Home prices in these areas are probably among the most affordable.

Looking to buy in Detroit? You can earn about $52,000 a year and still own a home. This was a 19% increase over the previous year, but it was also the minimum income needed to buy a home in the United States.

This was followed by three metros in Ohio (Akron, Dayton and Cleveland) and Little Rock, Arkansas, where buyers needed to have an income of at least $60,000 to purchase a home.

So-called pandemic boom cities with remote workers were the only regions with the smallest increase in income needed to make purchases, according to Redfin. These include Austin, Phoenix, and Boise.

In Austin, Texas, prospective buyers needed an annual income of $126,000 to afford a median-priced home, an increase of only 8% from a year ago, the study analyzed. It had the smallest increase of any subway in the United States. This happened even though Austin home prices fell 7% in August compared to the same month last year.

Homebuyers in Boise, Idaho, needed an income increase of 9% ($127,000) from a year ago, while homebuyers in Salt Lake City, Fort Worth, Texas, and Lakeland, Florida each needed about 13% more income than a year ago. recorded an increase.

read more: How much house can I buy?

“We need to increase supply.”

What will it take to reverse the high income trend? Simple: More homes come on the market.

According to Redfin, the number of new listings rose 0.8% in August from the previous month, marking the second increase after the first decline in a year. Overall, the number of new listings remained down 14.4% year over year.

Redfin analysts said the share of homes sold in August hit a record low, although supply is increasing slowly. The total number of homes sold was down 1.1% month-on-month and a seasonally adjusted 20.8% year-on-year, the largest decline since June 2021.

“Initial listings have likely bottomed out,” Chen Zhao, head of economic research at Redfin, said in a previous study. “Most homeowners who feel handcuffed to high interest rates have already made the decision not to sell. This means that many of today's sellers are struggling in some cases with divorce or family emergencies, Or, they may need to put their home on the market for reasons such as returning to their hometown.''This is the office's policy. ”

Another silver lining is new construction. According to the National Association of Realtors, as of the second quarter of 2023, newly built single-family homes account for nearly one-third of the nation's housing inventory.

For example: In Boise alone, new homes accounted for roughly 40% of single-family inventory in the second quarter, according to Redfin. This allows builders to offer buyers attractive incentives to drive sales, such as mortgage rate buydowns, upgrades, and mortgage rate increases. Prices fall by an average of 6%.

“The only way to sustainably lower prices is to increase supply,” Fairweather said. But “it's going to take a long time for that to happen.”

gabriella I'm a personal finance and housing reporter for Yahoo Finance. Follow her on Twitter @__Gabriela Cruz.

Click here for real estate and housing market news, reports and analysis to help you make investment decisions.

![Americans need a six-figure salary to buy a new home in most cities. [Video]](https://hustlersdailypay.com/wp-content/uploads/2024/02/bcd1bd0c20bfa4fc3fc3ab590b2dec42-768x512.jpeg)