Stocks have fallen from recent highs over the past month, but the bull market is likely not over yet. History shows that stock markets stay in uptrends longer than they go down. That's why it has returned an average of 10% per year over the past century.

Among various sectors, real estate investment trusts (REITs) offer great value and have the potential to outperform the market average in the coming years. These companies are required to distribute at least 90% of their profits to shareholders as dividends. And among REITs, real estate income (New York Stock Exchange: O) maintains a high-quality real estate portfolio, which has led to impressive consecutive dividend growth.

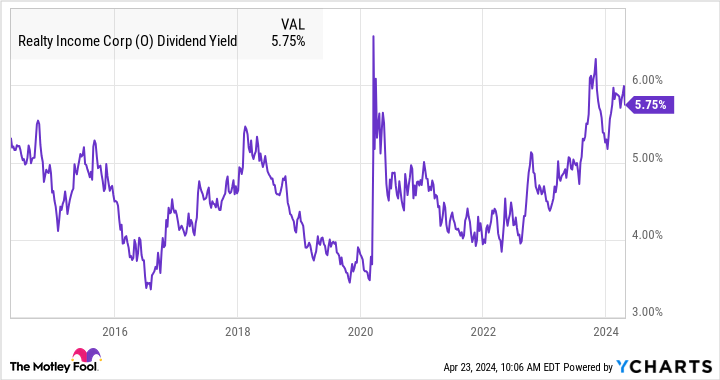

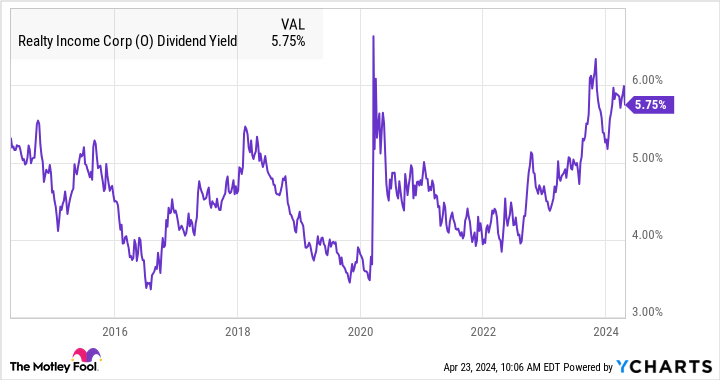

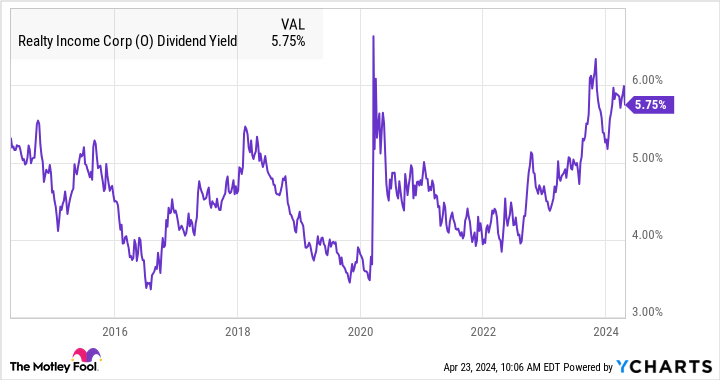

After a recent selloff, the stock now offers its highest yield in a decade. Here are three reasons why Realty Income stock is a great buy right now.

1. Sound investment strategy

Real Estate Income follows a smart investment strategy in the commercial real estate market. Although more than 80% of his clients are in the retail industry, he focuses on investing in real estate owned by companies that lead their respective markets. Among its biggest customers are well-known names such as: dollar general, walgreens, fedexand walmart.

Warren Buffett has always advocated investing in companies with sustainable competitive advantages, and that's exactly what Realty Income looks for in its retail clients. The company's real estate portfolio focuses on businesses that sell products at low prices. It also wants to invest in customers that can continue to grow in an era when retail spending moves online.

The proof is in the pudding. Realty Income has been increasing monthly dividends for 25 years and recently announced a monthly dividend of $0.257 per share for April.

2. $14 trillion addressable market

Historically, REIT stocks as a group have underperformed the S&P 500 Index. Investors generally buy his REITs for dividend yield above all else, but the gap in underperformance between REITs and the rest of the stock market is widening, which is good for value investors. is.

Realty Income stock has fallen 14% over the past year. However, the company focuses on high-quality real estate, and the attractive yield of 5.75% suggests the stock is undervalued and should bounce back sooner rather than later.

The company is actively looking to invest more capital in attractively priced real estate. The company is beginning to see opportunity in the data center market and has completed an initial investment of $200 million in a joint venture with digital realty In the fourth quarter.

Overall, management estimates there is $14 trillion worth of real estate in the U.S. and Europe that could become new investments. This means the company can be safely added to your portfolio to increase its dividend over many years.

3. Attractive dividend yield for a strong business

Although retail spending can rise or fall depending on the health of the economy, there have been very few years in the past few decades in which retail spending declined year-over-year. Since 1993, annual growth in retail sales has averaged 4.8%.

In any case, retail sales growth is not the issue. Real estate shareholders are not betting on the success of a single retail company, or even whether that company's customers will be successful. growing up their sales. As long as the company's customers can pay their rent, shareholders are fine.

Realty Income's dividend yield is the highest it's been in a decade. If history is any indication, this opportunity may not last long.

Need to invest $1,000 in real estate income right now?

Before purchasing real estate income stocks, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and real estate income wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

when to think about it Nvidia This list was created on April 15, 2005…if you invested $1,000 at the time of recommendation. you have $506,291!*

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor For the service more than 4 times The resurgence of the S&P 500 since 2002*.

See 10 stocks »

*Stock Advisor will return as of April 22, 2024

The bull market has arrived. 3 reasons why you should buy real estate income stocks like there's no tomorrow.Originally published by The Motley Fool