With just six weeks left in the 2023/24 marketing year, many buyers are finalizing purchases for shipment in June and July, shifting much of their export focus to the 2024/25 and 2024/25 marketing years. In other words, they are shifting to selling American wheat, a “new crop.'' Compared to a year ago, it is gradually growing at a faster pace. Below we outline the sales pace for 2023/24 so far and provide an overview of export sales for 2024/25.

Summary of 2023/24

Throughout 2023/24, market conditions shifted back towards buyers. From June 1, 2023 to the present, FOB export prices for U.S. wheat have declined by an average of 15% across all classes and export locations. This trend was driven by Black Sea competition, which weighed on U.S. and global wheat prices. As of April 30, 2024, Russian wheat remains the cheapest on the global market at $214 per metric ton (MT) FOB (12.5% protein on a dry moisture basis).

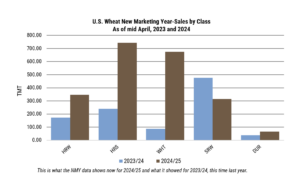

As world wheat prices fall, U.S. wheat prices follow suit, and lower prices help boost U.S. exports of two classes of wheat. To date in 2023/24, China has imported more than 1.2 million tonnes (MMT) of soft red winter (SRW), contributing to a 51% increase in the total export sales of SRW as of April 18, 2024. Similarly, Hard Red Spring (HRS) sales remained 13% higher than the previous year at 6.4 MMT and accounted for 34% of total US wheat export sales. Nevertheless, the strong export performance of HRS and SRW does not offset the significant decline in exports of Hard Red Winter (HRW) and Soft White (SW). To date, HRW exports have remained at 3.6 MMT, down 28% year-on-year. Similarly, South Wales exports are 15% below last year's pace.

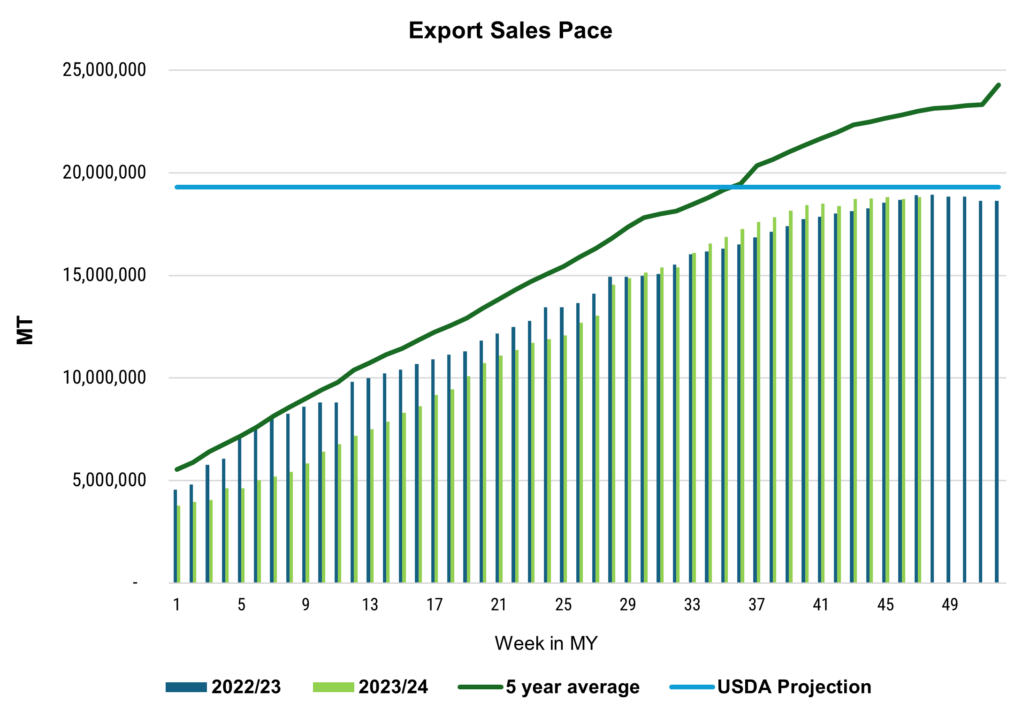

The pace of sales is expected to slow further in 2023/24 as customers demand shipments for June and July delivery. For example, in the week ending April 18, net sales for delivery in 2023/24 were reported to be just 82,000 tonnes (MT). Despite the increase in exports for some classes, USDA projects wheat exports, if realized, will reach 19.3 MMT, the lowest level since 1971/72. Furthermore, at the current pace, total commitments to date are 500,000 tons less than expected.

For the week ending April 18, net sales of 82,000 tonnes were reported for delivery in 2023/24. Year-to-date commercial sales in 2023/24 totaled 18.8MMT. USDA projects 2023/24 US wheat exports to be 19.3 MMT, with commitments to date representing 97% of total projected exports. Exports are now just 1% above last year's pace, but 17% below the five-year average. Source: USDA FAS Export Sales.

strong start

Although the pace of US wheat sales in 2023/24 has slowed, the outlook for new crop production in 2024/25 is more optimistic. Buyers are beginning to take advantage of low prices and secure early deliveries for 2024/25. In the week ending April 18, total known outstanding sales for the 2024/25 financial year reached 2.1 million tonnes, 112% above last year's pace, with net sales of 371,858 tonnes.

HRS continues to lead in export sales, selling 743,580 tonnes to date, an increase of 211% over last year. Similarly, soft white sales are up 670% to 675,180 tonnes, HRW is up 100% to 347,200 tonnes and durum sales are up 80% to 66,500 tonnes. As an outlier, SRW sales were 314,200 tonnes, 34% behind last year, as prices remained high compared to SW.

In the week ending April 18, the total known sales balance and cumulative exports of all classes of wheat for the 2024/25 market year reached 2.11 million tonnes, 112% above last year's pace, with net sales of 371,858 tonnes. It became. HRS export sales increased by 211% year-on-year, SW by 670%, HRW by 100% and Durum by 80%. As an outlier, SRW's sales are 34% behind last year's pace. Source: USDA FAS Export Sales.

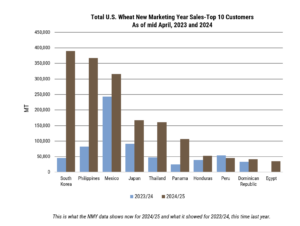

Contributing to the increase in sales, several customers have already purchased more US wheat in 2024/25 compared to this time last year. So far, South Korea has been the largest buyer of US wheat, with 389,500 tonnes reserved, up significantly from 45,300 tonnes a year ago. During the week of March 18, SW prices fell to $219/tonne (according to US Wheat Associates Price Report), following the downward trend in the global wheat market. During this period, Korean feed grain importers purchased cargoes of feed wheat from the United States, increasing imports in the Southwest. However, USW/Seoul country director Channy Bae said this is a short-term opportunity for South Korean feed producers, whose purchases will vary depending on the price of corn and other sources.

So far, the next largest buyers of new crops are the Philippines, Mexico and Japan, with increases of 348%, 30% and 83%, respectively, compared to the previous year. Similarly, buyers in Thailand and Panama significantly outperformed purchases in 2023/24, with increases of 239% and 336%. Some of the recent increase can be attributed to customer demand for products and pace of shipments, as well as customers taking advantage of more competitive pricing.

So far, South Korea, the Philippines and Mexico are the biggest buyers of U.S. wheat. Year-over-year increases of 760%, 348%, and 30% have been recorded so far. Buyers in Thailand and Panama also significantly exceeded their purchases in 2023/24, reaching 239% and 336% above last year's levels, respectively. Source: USDA FAS Export Sales.

stay tuned

There is one caveat to strong US wheat sales in early 2024/25. Traders point to farm sales as a potential limiting factor heading into 2024/25. Lower wheat prices reduce incentives for farmers to use storage as a hedge against sales. Lack of liquidity limits exporters' ability to aggressively price and market grain to meet increasing demand.

Looking ahead, the May 2024 Global Agricultural Supply and Demand Estimates will provide additional insight into U.S. wheat production, exports, and global demand. Similarly, weekly commercial sales reports provide real-time updates on the pace of U.S. wheat sales. As always, US Wheat Associates remains committed to providing information and support to buyers as we move into the 2024/25 marketing year.

Tyllor Ledford, USW Market Analyst