The U.S. job market could shift into slow gear this spring, a change in direction that economists have been anticipating for months after a strong recovery from the pandemic shock.

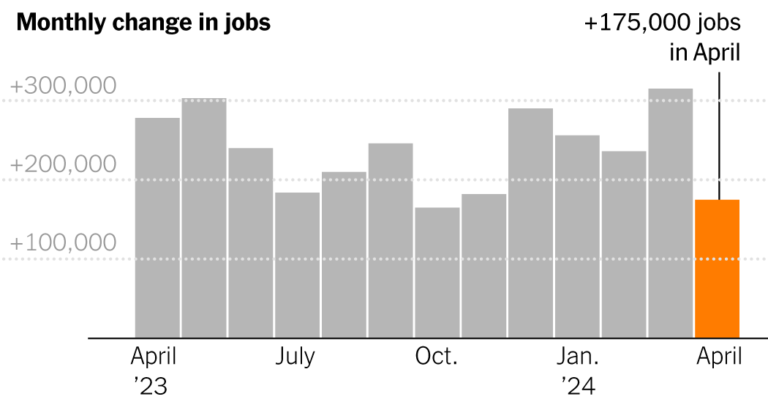

Employers added 175,000 positions in April, lower than expected, the Labor Department reported Friday. The unemployment rate rose to 3.9%.

After an average of 242,000 jobs over the past 12 months, the less intense economic expansion is not necessarily bad news, given that layoffs remain low and most sectors appear stable. isn't it.

“It's not that the economy is bad. It's still a healthy economy,” said Park Pineda, chief economist at the Plastics Industry Association. “I think it's part of a cycle. Given the limitations of the economy, we can't continue to have strong growth forever.”

The labor market has defied predictions of a sharp slowdown for more than a year in the face of rapidly rising borrowing costs, a small banking crisis and two major wars. But economic growth slowed markedly in the first quarter, suggesting the boom of the past two years may be settling into a more sustainable rhythm.

Wage growth has slowed, with average hourly wages increasing 3.9% year-on-year (up from 4.1% in the March report). Faster wage growth in the first quarter, evidenced by better-than-expected Employment Cost Index readings, may partially reflect salary increases and minimum wage increases that took effect in January, as well as new union contracts There is sex.

The number of hours worked per week has fallen, again showing that employers need to reduce staff. The broader unemployment rate, which includes people working part-time for economic reasons, rose slightly from its record low in late 2022 to 7.4%.

The findings may be welcome news for the Federal Reserve, which has kept interest rates on hold while inflation remains stubborn. Federal Reserve Chairman Jerome H. Powell said this week that the Fed is not targeting lower wage growth, but added that sustained wage increases could prevent inflation from subduing.

The new data sent bond yields lower and stocks rose as some doubted the Fed would cut rates before the end of the year.

President Biden celebrated the report as a continuation of “America's great comeback,” while former President Donald J. Trump, his putative rival in the November election, trumpeted the report on his Truth Social platform. He characterized the book as having “horrible employment numbers.” Under President Trump's administration, until March 2020, when the pandemic was in full swing, the average monthly increase in employment was about 180,000, which was only slightly higher than the increase in April.

The April figures are in line with other indicators of economic weakness that have been mounting in recent months. Job openings are down significantly from their peak two years ago, and worker turnover is lower than before the pandemic. Additionally, the employment statistics for February and March were better than expected, but the unusually warm winter may have been a tailwind.

“It's not surprising that in this economic environment where we've seen a significant easing in labor demand and where interest rates remain high, employment is also slowing,” said Lydia Boussour, senior economist at consulting firm EY Parthenon. Ta.

Employment growth has been limited to a few industries, a trend that was maintained in April's seasonally adjusted figures, with health care, driven by an aging population and less cyclical, leading to 3% of the growth. It accounts for 1/2 of the total.

Leisure and hospitality employment increased slightly, halting much faster growth as industry staffing approaches pre-pandemic levels.

The impact of rising interest rates is most clearly felt in manufacturing, a capital-intensive sector where employment has been essentially flat since the second half of 2022. Federal incentives for the production of semiconductors and clean energy equipment have generated investment, but the impact on employment has been muted. .

So does Voith Hydro in York, Pennsylvania, which makes machinery for dams and pump storage facilities, a way to manage electricity demand. Some orders were spurred by the Infrastructure Investment and Jobs Act, and more recently, tax cuts from the Inflation Control Act helped spur new equipment installations.

Voith last year signed new contracts with unionized employees with better pay and benefits to stay competitive with nearby employers, but 350 employees stood out. It is not showing any expansion.

“There are fewer people coming into the trade and fewer people to choose from,” said Carl Atkinson, vice president of sales and marketing for the hydropower division. “This simply means that the entire group of manufacturers is challenged to become more efficient.”

This strategy has contributed to strong productivity growth over the past few quarters and helped wages rise faster than prices. Depending on how many people start looking for work, these efficiency gains could also spur unemployment rates to rise. But so far, worker supply has been a key factor driving surprisingly strong job growth over the past two years.

Part of that is due to an increase in the influx of legal and illegal immigrants, which added about 80,000 people to the labor force each month last year and is expected to add another 50,000 people each month this year, according to estimates by Goldman Sachs. is. Economists at the Brookings Institution estimate that immigration could add 160,000 to 200,000 jobs a month in 2024 without fueling inflation.

But labor availability was further strengthened by a record 78% labor force participation rate in April among women aged 25 to 54, generally considered to be in their prime working years.

Among those returning to the job market this year is Juliet Gore, 46, who worked in sales at credit reporting company Equifax before taking time off to raise her three sons. She then started a computer network equipment business with her husband in the Atlanta suburbs, but she sold her shares upon her divorce in 2022.

After spending a year renovating his home, Gore began looking for work in early 2024. The timing turned out to be bad, as professional services employers were backing away after a rapid hiring campaign. She sent in dozens of applications, but only two of hers got interviews, and even the closest job offer came at a much lower salary than she was willing to accept.

“It's going to take a lot longer than we expected,” Gore said. “Some say things won't get better until early next year.”

The decline in job opportunities may be causing some people to turn to gig employment, but that's not reflected in the monthly employer survey. The share of accounts with app-based income reached a record high in the first three months of this year, with most of that coming from ride-sharing, according to a Bank of America analysis of proprietary data.

Rising unemployment may curb consumer spending, and consumers are also depleting bank balances built during the pandemic, but it still leaves us with a fundamentally healthy economy.

“We still expect what we would call a mild economic slowdown, but things are improving again,” said Stephen Brown, deputy chief North American economist at Capital Economics. “The average worker won't notice any slowdown.”