On May 6, 2024, Amanda Hodges, Executive Vice President and Chief Marketing Officer of Republic Services, Inc. (NYSE:RSG) sold 6,500 shares of the company's stock. This transaction was filed with her SEC and you can see the details here.

Republic Services Inc is a leader in the environmental services industry, providing non-hazardous solid waste and recycling services to commercial, industrial, municipal and residential customers through its subsidiaries.

The shares were sold at a price of $186.02, giving a transaction value of approximately $1,209,130. This insider sale is part of a broader trend where there have been four insider sales and zero insider buys over the past year. In the past year, Amanda Hodges sold a total of 9,212 shares of Republic Services Inc. stock, but did not buy any shares.

Republic Services Inc's stock currently has a market capitalization of approximately $59.38 billion. The company's price-to-earnings ratio is 33.08, which is higher than both the industry median of 20.545 and the company's historical median.

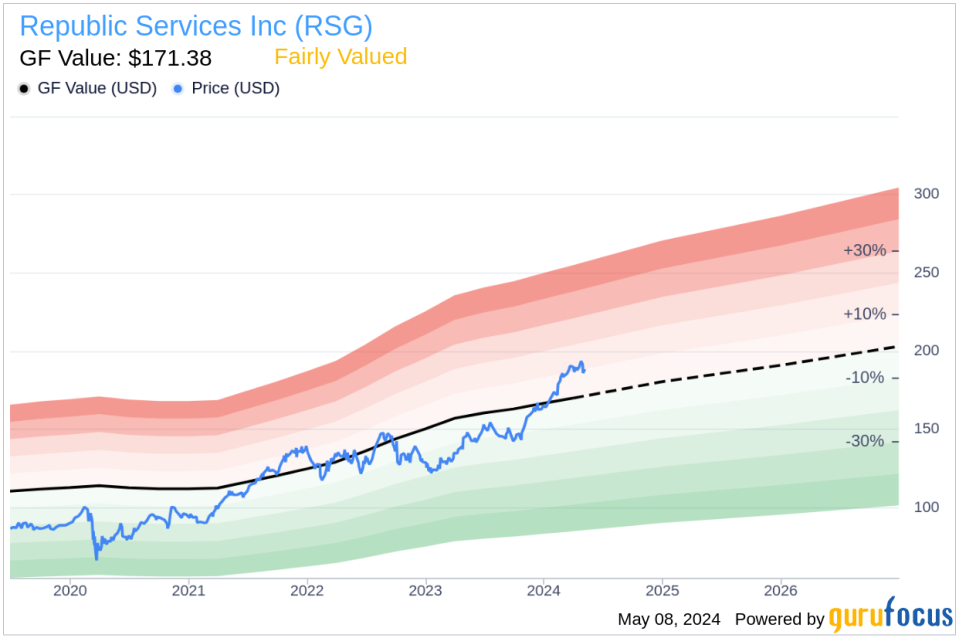

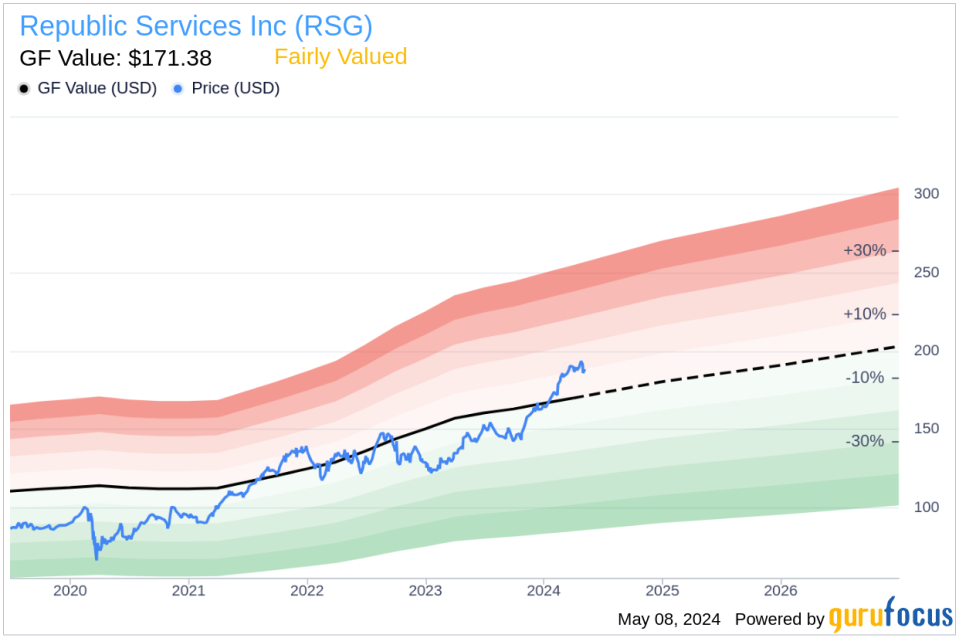

According to GF Value, the intrinsic value of the stock is estimated to be $171.38, giving a current price to GF Value ratio of 1.09. This suggests that the stock is fairly valued.

GF Value is calculated based on historical trading multiples, GuruFocus adjustment factors, and future performance estimates provided by Morningstar analysts.

This recent insider sale may provide investors with information on how Republic Services Inc. executives view the stock's valuation and future prospects.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.