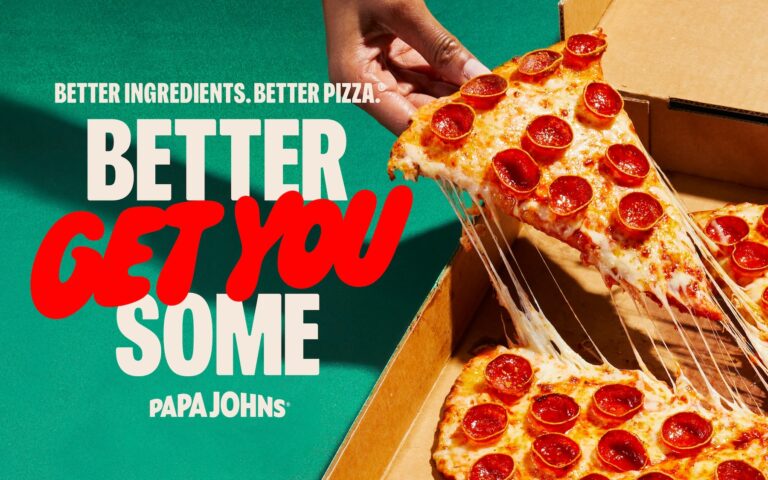

Papa John's new marketing efforts were offset by a weak consumer economy. | Image courtesy of Papa John's

It appears the consumer environment is too difficult for Papa John's new marketing.

The Atlanta-based pizza chain said Thursday that same-store sales in North America fell 2% in the first quarter and didn't fare much better in the second quarter, prompting franchisees to increase funding and launch heavy marketing efforts. Despite the activities, it announced that the number has decreased by 1% to date.

As a result, the company has lowered its full-year same-store sales forecast from a low-single-digit increase to flat to decline. The results sent the pizza chain's stock price down more than 7% on Thursday.

Shake Shack's chief financial officer, Ravi Tanawala, who was appointed interim CEO in March following Rob Lynch's departure for Shake Shack, blamed the consumer environment for the problem. .

He suggested that the drop in consumer confidence is causing customers to visit stores less often or spend less when they do.

“March sales were slightly lower than expected,'' Mr. Tanawala said. “Consumers have a little more control and drop-off rates are slightly higher at certain points in the consumer funnel.”

Franchisees overwhelmingly agreed last year to direct marketing spending to national efforts. Rather than spending on local marketing, they would donate an additional 1% of their profits to the National Marketing Fund.

The goal, former CEO Lynch said, was to shift spending to areas with the highest return on investment.

The company then introduced a new tagline, “Better get you some,” and ramped up its marketing in April. Executives and franchisees suggested this would increase sales.

But the economic downturn has taken its toll on consumers, and in recent months they've expressed their concerns about prices with their feet, making them visit restaurants from McDonald's to Olive Garden less frequently.

Papa John's is ordering delivery less frequently through the company's own ordering channels.

The chain's same-store sales fell 2% despite increased demand from third-party delivery users. Papa John's blames the problem on a decline in sales from organic delivery, which apparently more than offsets the increase in sales the company has received from partnerships with Uber Eats and DoorDash. was.

This combination means Papa John's relies more on third-party delivery than other chains, with 16% of its sales now coming through aggregators.

“The reason we've been able to stay strong is because we've done well in that area,” Thanawala said.

Still, he added, “the long-term goal is that our core business does not decline and that our growth will only come from aggregators.”

Papa John's performance clearly reflects broader weakness in the U.S. pizza market outside of Domino's.

Same-store sales at the Ann Arbor, Michigan-based pizza chain rose 5.6%, rebounding from a two-year slump following the pandemic. But Papa John's and Pizza Hut, whose same-store sales fell 6% in the first quarter, are both struggling to start 2024.

But so far this year, restaurant chains in several sectors have struggled with weak customer traffic and weak consumer spending.

“Throughout April, we saw continued softening in consumer behavior, particularly in transportation and check management components,” Thanawara said. “And that's a difference from what we actually started seeing in April.”

But the results put Papa John's in a tough position this year. The company had just announced a new marketing strategy, only to see Lynch, the CEO and engineer behind that strategy, leave for Shake Shack.

Our members help make our journalism possible. Become a Restaurant Business member today and enjoy exclusive benefits, including unlimited access to all content. Sign up here.