Do you own a Florida condo? Can you afford a special assessment of $100,000 or more for new safety standards?

After the Surfside building collapsed on June 24, 2021, killing 98 people, the state passed structural safety laws that are now hurting owners.

Not only are insurance premiums soaring, but owners are also facing huge special assessments of more than $100,000.

Florida's new law disrupts condominium market

The Wall Street Journal reported that Florida's new law is disrupting the apartment market.

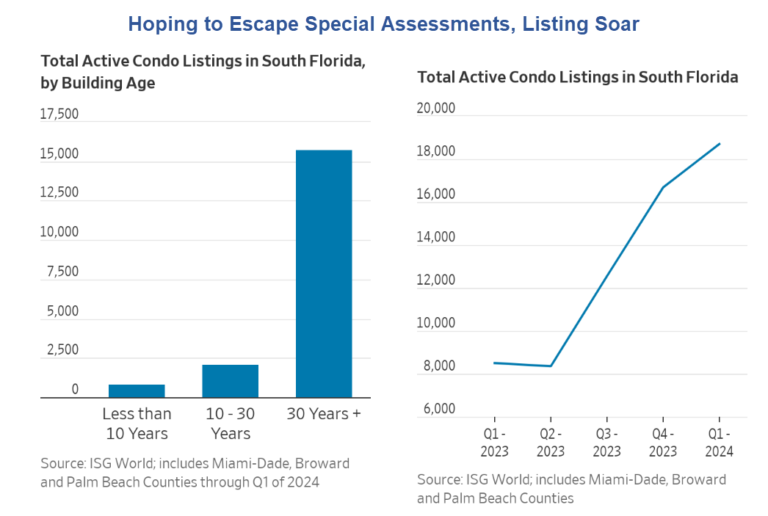

The inventory of condos for sale in South Florida more than doubled from the first quarter of last year to more than 18,000 units. Rising home insurance premiums in Florida are causing some homes to be sold, but most of the properties on the market are more than 30 years old. Under the new law, buildings must pass a milestone structural inspection within 30 years of construction.

According to Zillow, approximately 38% of Miami's housing stock is condos, the highest of any major U.S. metropolitan area. Almost three-quarters of these buildings are more than 30 years old. For homes that are in need of major renovations, many owners are scrambling to sell by Jan. 1, when the building's reserve fund must be fully covered to comply with the law.

“I think this is just the beginning,” said Greg Main-Bailey, executive managing director of real estate firm Colliers, which oversees 40 apartment renovation projects across the state.

Owners are having a hard time finding all-cash buyers, as mortgage lenders are increasingly unwilling to take on the risks associated with these units. “It's not the purchasers who are ineligible,” said Craig Studnicki, CEO of ISG World. “It's the building that's ineligible.”

Previously, state law allowed condominiums to exempt their reserves each year, leaving many buildings, including the nearly 50-year-old cricket club, with little money in their coffers. Currently, about 40 of the 220 buildings are for sale, but there is little interest..

“These properties are effectively being abandoned,” said Sari Papir, a former real estate agent who has lived at the Cricket Club since 2018 with her partner Scholl Schleifer. Will we receive it for our troops? ”

Some developers are concerned that condos in the building have already been purchased for a potential takeover. A takeover is when a developer attempts to gain control of a building in order to demolish it and build a newer, more luxurious building. These condo eliminations are occurring up and down the state's coastline. Rules may vary from building to building, but if enough people vote to sell their units, others must follow.

There is no way to escape from evaluation.

Those who cannot sell and do not have special assessments will be evicted and have their units foreclosed on, doing whatever the association can get for them.

The number of listings in South Florida has doubled in the past year to more than 18,000. Very few units will sell, and those that do will be marked down significantly.

The newspaper focused on the plight of Ivan Rodriguez, who liquidated his 401K and bought a condo for $190,000. He then faced his $134,000 special assessment. He ultimately sold the unit for $110,000.

Are you familiar with the insurance blues?

Car insurance has increased by more than 20% compared to a year ago. In many areas, private home insurance is not available at all. Consumers are excited.

I asked on February 17, 2024 Are you familiar with the insurance blues?Auto and home insurance costs are rising

Auto insurance is doing surprisingly well. Premiums have increased by at least 1.0% for 13 consecutive months. Auto insurance has increased by at least 0.7% for 20 straight months.

If you can get it from a private insurance company, home insurance is also rapidly increasing in price.

If you live in a flood zone, hurricane zone, or fire zone, it can be very difficult to get insurance.

Proposition 103 backfires, State Farm to cancel 72,000 California policies

State Farm will not renew insurance coverage for 30,000 homes and 42,000 businesses in California, citing wildfire risk. The government, not the insurance company, is responsible.

What I pointed out on March 26th is that Proposition 103 backfires, State Farm to cancel 72,000 California policies

Proposition 103 limited annual increases for insurance companies. State Farm responded by canceling 72,000 policies.

idiot reaction

“The industry is not going to start protecting Californians again without an order,” said Carmen Barber, executive director of Consumer Watchdog.

“That's why we believe Congress needs to step in and require insurance companies to cover people.”

Force companies to cover their personnel. Oh my god. All insurance companies will withdraw and everyone will be enrolled in the “FAIR” plan.

think!

Think carefully about where you want to live. Also, in the case of condominiums, you should be prepared for a high special assessment.

And above all, know your builder. For discussion, see . American home builder: DR Horton's house collapses in a few months