It's been an incredibly volatile start to the decade for Wall Street. Dow Jones Industrial Average (DJINDICE: ^DJI)standard S&P500 (SNPINDEX: ^GSPC)driven by growth stocks Nasdaq Composite (NASDAQINDEX: ^IXIC) I have been trading bear markets and bull markets for years.

But for the past 17 months, it's been nothing but a green light for bulls. Since the start of 2023, the Dow Jones, S&P 500, and Nasdaq Composite are up 20%, 38%, and 60%, respectively, with all three indexes hitting record highs. On the surface, it appears that there is no slowing down this red-hot market.

But looks can be deceiving.

Wall Street's perfect bear market signal is back!

Let me preface this discussion by stating clearly that there is no such thing as a predictive or financial indicator that can guarantee the direction of the Dow, S&P 500, or Nasdaq Composite with 100% accuracy. If such a predictive tool existed, every professional and individual investor would use it to gain an edge.

However, there are also select indicators or value-based indicators that have a long history of being closely or perfectly correlated with large gains or falls in the stock market. One such indicator with a perfect track record of predicting bear markets, movements in which market-wide indexes decline by at least 20%, is back and issuing a clear warning to investors who will listen.

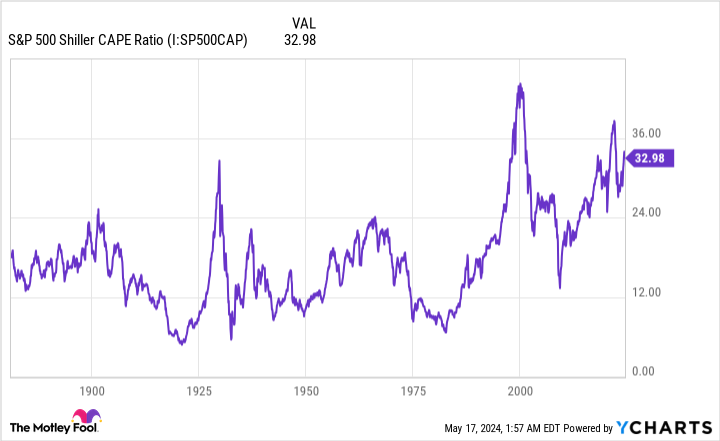

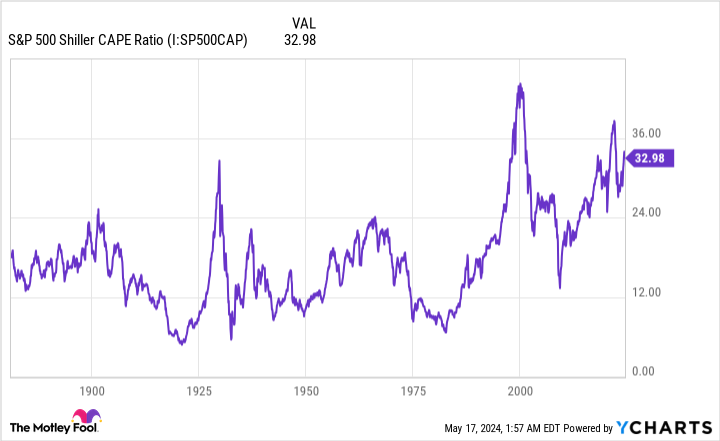

This obvious predictive tool is none other than the Shiller Price/Earnings Ratio (P/E) for the S&P 500. This is also known as the economy-adjusted price-to-earnings ratio (CAPE ratio).

Most investors are likely familiar with the traditional P/E ratio, which looks at a company's earnings over the past 12 months compared to its stock price. The Shiller P/E ratio is based on the average inflation-adjusted earnings over the past 10 years. Using 10 years of earnings history smoothes out the impact of his one-time events, such as the COVID-19 pandemic, and gives investors a clearer picture of valuation trends. .

As of May 16th, the day when the Dow Jones Industrial Average briefly exceeded $40,000 for the first time on an intraday basis, the S&P 500's Shiller P/E ratio closed at 34.66. This is more than double his average backtested Shiller PER of 17.12 through 1871.

But the concern isn't just how much the Shiller P/E ratio is above the historical average. Rather, that's what has happened every time the Shiller P/E ratio has exceeded (and exceeded) 30 during the upswing of a bull market over the past 153 years.

Since 1871, the Shiller P/E ratio has exceeded 30 only six times during a bull market, and all five of those times affected major stock indexes. Finally Tumbling:

-

August-September 1929 1929: Just before the Great Depression took hold, the Shiller P/E exceeded 30 for the first time. The Dow Jones ultimately lost 89% of its value over the next few years.

-

June 1997-August 2001:The all-time high for Shiller P/E (44.19) was recorded before the dot-com bubble burst in December 1999. When the dot-com bubble burst, the S&P 500 lost about half its value and the Nasdaq Composite Index fell. Hit even harder.

-

September 2017 – November 2018: Shiller P/E exceeded 30 again for more than a year from 2017 to 2018, which led to a 20% decline in the S&P 500 index in the fourth quarter of 2018.

-

December 2019 – February 2020: The Shiller P/E ratio was rising rapidly just before the COVID-19 pandemic. The coronavirus crash wiped 34% from the S&P 500 in 33 calendar days.

-

August 2020 – May 2022: In the first week of January 2022, the Shiller P/E peaked at just over 40. After this peak, all three stock indexes endured bear market declines, with the Nasdaq down 33% in 2022.

-

November 2023 to present: As mentioned earlier, the Shiller P/E is approaching 35, which is the third highest of any individual bull market.

The caveat above is that the Shiller P/E ratio does not help determine when a decline in the Dow, S&P 500, or Nasdaq Composite Index will occur. For example, during the dot-com bubble, valuations remained elevated for more than four years before reversing, but the COVID-19 crash came as a complete surprise.

But the Shiller P/E ratio clearly shows that rising valuations are not sustainable over the long term. The advent of the Internet and historically low interest rates increased investors' appetite for risk-taking, which partially explains the rise in his Shiller P/E since the mid-1990s. Shiller P/E was around $35. This is a pretty clear bear market warning for Wall Street and investors.

History is an unbalanced coin with two sides favoring the patient and the optimist.

Given how strong the bull market rally has been over more than a year, a cautionary tale about a potential bear market is probably not what investors want to hear. But it's important to have this discussion to recognize that history is very much a corner for optimistic investors with a long-term mindset.

Frankly, recessions, stock market corrections, and even bear markets are normal and inevitable events. We may hate the idea of our stock portfolios temporarily being swallowed up in a sea of red or our wage growth slowing during an economic contraction, but for all the hope in the world that these events sometimes You can't stop it from becoming reality.

But this is where history comes in handy. Of the 12 recessions in the United States since World War II ended in September 1945, only three lasted one year. None of his remaining three cases exceeded his 18 months in duration.

The other side of this historical coin is that most periods of growth last for multiple years, including two economic expansions that lasted more than a decade. Most publicly traded companies on the Dow, S&P 500, and Nasdaq Composite can take advantage of extended periods of expansion.

This two-sided and disproportionate coin that we call history also applies to Wall Street.

In June 2023, Bespoke Investment Group researchers released a dataset examining every bear market and bull market in the S&P 500 dating back to the beginning of the Great Depression in September 1929. As you can see in the above post by Bespoke on social, there were 27 separate bear and bull markets on media platform X.

Notably, the average duration of the S&P 500 bull market (1,011 calendar days) is approximately 3.5 times longer than the typical S&P 500 bear market (286 calendar days) over 94 years. Additionally, the 13 bull markets lasted longer than the longest bear market since the Great Depression. Being an optimist on Wall Street is definitely beneficial.

But it's also important to keep an eye on the horizon. A study by Crestmont Research, an economic research firm, analyzed the total return of the S&P 500 index over a 20-year period, including dividends paid, since the beginning of the 20th century. Although S&P was created in 1923, researchers were able to backtest it back to 1900 by tracking the returns of components of other major indexes before its creation.

Crestmont Research found that all 105 of the 20-year periods studied (1919-2023) had positive total returns. In plain English, let's say you purchased the S&P 500 Tracking Index from the following site: Any Since 1900, you could make money by holding your points for 20 years. Twenty years later, the S&P 500 is still consistently higher on a total return basis, no matter what doomsaying predictions are thrown at Wall Street.

Even if history repeats itself and valuations shrink significantly in the not-too-distant future, patient investors are likely to benefit from short-term discounts on blue-chip stocks.

Where you can invest $1,000 now

whenyour analyst team With stock tips, you can pay just to listen. After all, the newsletter they've been running for over a decade is Motley Fool Stock Advisor, the market has nearly tripled. *

they just made it clear what they believe Best 10 stocks Investors can buy now…

See 10 stocks

*Stock Advisor will return as of May 13, 2024

Sean Williams has no position in any stocks mentioned. The Motley Fool has no position in any stocks mentioned. The Motley Fool has a disclosure policy.

Wall Street's bear market warning is back with a vengeance Originally published by The Motley Fool