Changing jobs has forced me to think more carefully about how I manage my spending

December 12, 2023 6:00 a.m.(Has been updated 4:03 p.m.)

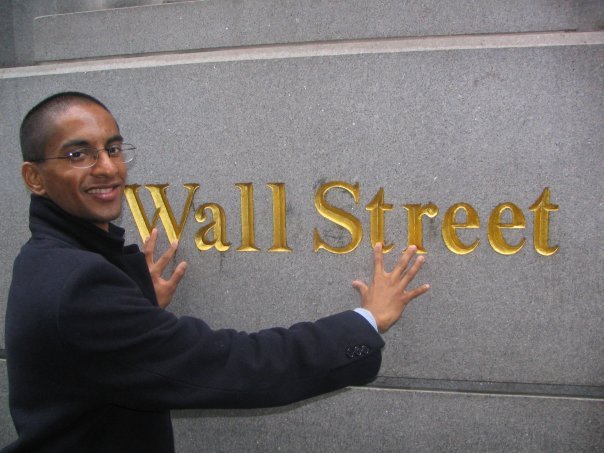

Growing up on a gritty East London council estate in East Ham, I could see the glittering towers of the global financial giants of Canary Wharf from my local park.

And in my early twenties, I got a job in one of those towers. I was a trader at investment banking superpower Lehman Brothers, but before it went bankrupt I moved to investment banking Nomura. Afterwards, I qualified as a certified public accountant at PwC.

At the peak of his earnings he earned a six-figure salary, but then spent it all at the age of 30 and retrained in a career with a starting salary of £20,000. I decided to become a school teacher, but the salary reduction was dizzying. So why did the sparkle occur?

Well, a good education changed my life. And in his twenties, I co-founded the social enterprise OxFizz to support thousands of disadvantaged students applying to university. While working at PwC, I essentially took a sabbatical from client work to train new employees joining the firm.

It dawned on me that by educating others, I could make a tangible difference in my personal life. So blackboards, calculators, and math exercise books became my calling. Although I felt that inner glow of actually making an impact, I can't deny that it took a toll on my ability to balance my finances.

Of course, earning a large amount of money brings changes in your life. You can buy fashionable things. You can spend a luxurious holiday. Easily meet your bills. You can scatter cash to your loved ones.

However, as per the Parkinson's Money Law, your expenses will increase in proportion to your income. and “normalize” new levels of material objects and experiences. Our income needs to grow again to provide psychological stimulation with products and experiences for a whole new demographic. We found that even with six-figure incomes, your actual happiness doesn't continue to rise linearly even as your income skyrockets.

So, was it difficult for you to have your income suddenly drop when you started teaching?

I found this quote from one of my favorite childhood books, 1850 by Charles Dickens, helpful. david copperfield. The character Mr. Micawber gave this advice: “Annual income: £20, annual expenditure: £19” [pounds] 19 [shillings] and 6 [pence], you will be happy as a result. If you earn £20 a year and spend £20 a year, £6 would be disastrous. ”

Ultimately, Micawber's principle of living within your means is a simple one. If you continue to spend more than you earn, you will eventually find yourself in serious trouble. On my part, this adjustment required adapting and managing my lifestyle expectations.

What has happened to me personally is, in some ways, a reflection of what has happened on a national level over the past few years. Wage freezes and peak double-digit inflation have reduced our collective purchasing power.

We had to adjust our spending and learn how to cut our budget. Do we really need all those streaming subscriptions? Are we really taking advantage of our premium memberships at the gym? Do we need the latest Nike Air Jordans? Does that mean we need all those pumpkin spice lattes from Starbucks? It doesn't mean quitting, but it does mean thinking more carefully about your spending decisions.

I had to think more carefully about how I managed my spending. But I will tell you that since I made lifestyle adjustments, my happiness has actually steadily increased.

According to the 2023 World Happiness Report, Finland is the country with the happiest people (closely followed by Denmark and Iceland). However, Finland ranks even lower as the richest country in terms of GDP per capita, at 21st place.

Of course, having more wealth makes life more comfortable, but it doesn't necessarily correlate with being the happiest. In Finland, their well-being is rooted in a close relationship with nature and a down-to-earth lifestyle. The spirit of a country where people are trusting, tolerant and mutually cooperative is also important.

But in times of real economic hardship, it can be mean to ignore people who have to make difficult decisions. Life has dealt some people a rough card. Some people have no choice but to borrow money. In these situations, people may feel forced to borrow through high-interest debt or schemes such as buy now, pay later.

However, these should be viewed as a last resort, especially for those fortunate enough to be able to consider cutting spending rather than selling completely.

Money is important. Only the privileged and stupid would say otherwise. But when you have enough to meet your basic needs and a little more to get additional comforts, you realize that money comes and goes. What's more valuable is how you treat those around you and the impact you can have on their lives.